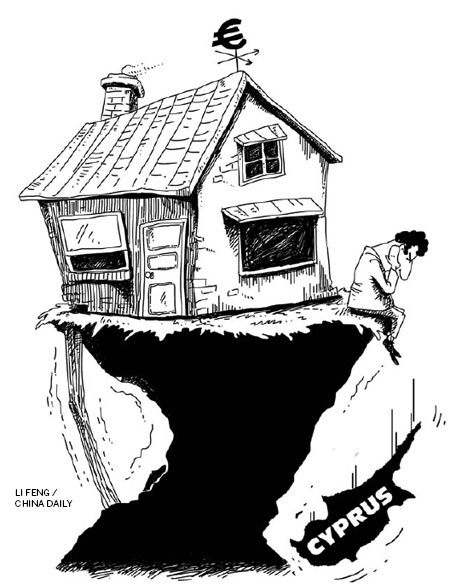

Rolling the dice to save Cyprus

The task of imposing losses worth about 5.8 billion euros ($7.5 billion) on lenders to the Cypriot government and depositors with the country's banks was never going to be an easy one. That effort has now led European Union to its latest impasse.

In marathon negotiations, the Cypriot government, under the supervision of the European Commission, European Central Bank and the International Monetary Fund, agreed to a one-time "tax" on bank deposits. But despite an amendment to exempt accounts containing less than 20,000 euros, the Cypriot parliament overwhelmingly rejected the plan, leaving Cyprus - and EU - in limbo.

In fact, large depositors are not unlike senior bondholders, and the proposed haircut was a small but welcome step forward. But, because it did not go far enough, a hole remained. There were other options. Lee Buchheit, a veteran sovereign-debt attorney who should have been in the negotiating room, and Mitu Gulati of Duke University have proposed an elegant "reprofiling" of Cyprus's 15 billion sovereign debt that would instantly reduce the financial pressure on the country. But such considerations were off the table well before the deliberations began.

Instead, the initial decision was to confiscate just under 3 billion euros from accounts containing less than 100,000 euros - the cutoff for deposit insurance. Make no mistake; this would have been the greatest policy error since the start of the global financial crisis five years ago.

Indeed, the proposal amounted to a rupture with the near-universal agreement that small depositors should be considered sacrosanct. After all, televised news footage of panicked depositors in long queues outside banks and at ATMs can cause immeasurable financial damage far beyond a country's borders.

Historians will argue whether forcing Lehman Brothers into bankruptcy in September 2008 precipitated the subsequent global financial crisis. Vincent Reinhart, formerly of the US Federal Reserve and now at Morgan Stanley, has argued that the Lehman decision was correct (the error came earlier, with the bailout of Bear Stearns, which created an expectation that all banks would be bailed out). Private risks must be privately borne.

By contrast, the proposal to impose losses on small Cypriot depositors had no redeeming justification whatsoever. As in Ireland, the most vulnerable were being asked to take the hit, while large depositors were let off lightly and other lenders were to be spared. But it gets worse.

There has never been an official explanation of why lenders to a sovereign should not share the pain, despite the "no bailout" principle on which the eurozone was founded. Most observers cite the authorities' concern that if any sovereign does not honor its debts, all sovereign borrowers will be penalized. But such contagion risk is trivial compared to the wildfire that could be ignited by imposing losses on small depositors.

In mid-2007, Cyprus qualified for eurozone membership by meeting the stringent Maastricht criteria, intended to ensure that new entrants would behave responsibly and flourish in the secure environment provided by the currency union. In the months leading up to the decision, the IMF urged Cyprus to take all necessary steps to ensure a favorable outcome.

The benefits of Cyprus's adoption of the euro may never be clear. By 2009, the IMF's Article IV Staff Report was already ringing the alarm bells. Public debt was still low, but growing rapidly, the current-account deficit was ballooning (reaching 15 percent of GDP in 2008) and the banks had gone Icelandic, with assets worth more than three times Cyprus's GDP. As the report noted, the huge and highly concentrated banking sector's problems could "quickly escalate to systemic proportions with serious economic repercussions." And so they have.

This is a remarkable outcome, given that the risks have been so well known and understood. Indeed, the Cypriot authorities have been engaged in ongoing discussions with the troika (EC, ECB and IMF) for the past year. And yet, despite all the preparation, a night of closed-door negotiations led to a stunningly elementary error.

Compounding that error was the absence of any substantive decision concerning how to extricate Cyprus from its downward spiral. Cypriot debt, we are told, will rise to 140 percent of GDP, and will fall to about 100 percent of GDP in less than a decade. This appears to be another replay of the Greek scenario, with targets for reducing the debt burden repeatedly missed, until more drastic steps become inevitable.

Most importantly, no restructuring of Cypriot banks appears imminent. On the contrary, the intent seems to be to keep large depositors from fleeing and preserve the highly risky system. The Central Bank of Cyprus has provided large loans to Cypriot banks under the Emergency Liquidity Assistance arrangement, implying that the collateral offered did not meet the standards of the ECB. More train wrecks are in the making.

The problems in Cyprus now threaten international financial stability. If the idea of a European banking union is serious, now is the time to advance it. That means reaffirming the commitment to deposit insurance, closing unviable banks and recapitalizing the rest with European (not Cypriot) funds.

The troika's decision on Cyprus was akin to policymaking by rolling the dice. The coming days will reveal the extent of the immediate damage that it has caused. But, with another display of reactive and ad hoc decision-making, we are no wiser about how Europe intends to resolve its dilemmas. Could the Cypriot setback catalyze a fresh start?

The author is visiting professor of International Economic Policy at the Woodrow Wilson School of Public and International Affairs, Princeton University, and a former mission chief for Germany and Ireland at the International Monetary Fund.

Project Syndicate