As euro nears dollar parity, how much further will it decline?

The euro is notching one milestone after another as it drops against major currencies. On Wednesday, it hit a 12-year low against the dollar and many think its descent has further to go.

The fall in Europe's single currency has been dramatic - 25 percent since May, when it traded just shy of $1.40. Back then, companies across Europe openly fretted about the strength of the euro and its impact on their exports.

Such concerns are now more likely to be heard out of the United States or the United Kingdom, which are seeing their currencies rebound against the euro. On Wednesday, the euro fell as low as $1.0557, its weakest against the dollar since April 2003.

So what has prompted the euro's plunge?

Euro excess

The main reason is the European Central Bank has not only cut interest rates but also started creating more euros to put into the financial system.

The ECB had been reluctant to do so for years, but in 2014 it changed course. As policymakers faced the prospect of minimal growth and falling prices, which can further weigh on an economy, it cut its main interest rate in September to 0.05 percent. The move hit the euro by reducing the potential returns on investments in the eurozone.

As that proved insufficient to turn the eurozone around, the ECB has started buying government bonds in the markets with newly created money. The hope is that the 18-month 1.1 trillion-euro ($1.12 trillion) monetary stimulus will shore up the economic recovery and get inflation back into the system.

Whether or not the stimulus works, it will increase the number of euros in circulation, diluting their value.

The stimulus should also keep a lid on the borrowing rates of most eurozone countries in the markets - the ECB's buying shores up the value of the bonds, thereby reducing the potential yield on those bonds. With the yields on European government bonds at historic lows and in some cases negative, the returns to investors are negligible at best, further weighing on the euro.

Fed factor

The euro has fallen against many currencies, but its drop has been particularly pronounced against the dollar.

That is because while the ECB's policies have been weakening the euro, the US Federal Reserve's are bolstering the dollar.

As the US economy keeps growing and creating jobs, the Fed ended its own bond-buying stimulus program and said it is ready to soon start raising interest rates. Last week's stronger-than-expected jobs figures for February ratcheted up expectations that the first rate increase will take place in June.

For those looking for higher returns, holding US assets has become a more enticing prospect. Just look at the returns available on holding the 10-year US Treasury - the yield stands at 2.14 percent against 0.18 percent for Germany's.

The dollar has been rising not only against the euro but a range of currencies. Against the Japanese currency, it was near 122 yen, the highest since 2007.

Greece lightning

Concerns over a Greek exit from the euro have been an additional burden on the euro over the past few months.

The rise of a new government in Athens that wants to renegotiate a large part of the country's bailout terms has raised the prospect of a "Grexit".

Those tensions are likely to linger as Greece and the eurozone creditors will be stuck for weeks, if not months, on how to lighten the country's rescue loans.

Stunted growth

Many eurozone economies still have trouble growing, and that has discouraged some investors from putting their money in the currency bloc.

Relatively small economies like Portugal and Ireland are just emerging from bailout programs that required them to make huge budget cuts. Big economies like Italy, Spain and France are still focusing on reducing debt rather than spending.

At the very least, the economic outlook for the eurozone isn't rosy, and that's likely to require lower interest rates from the ECB than the Fed, for example, and that prospect has been another reason hurting the euro.

|

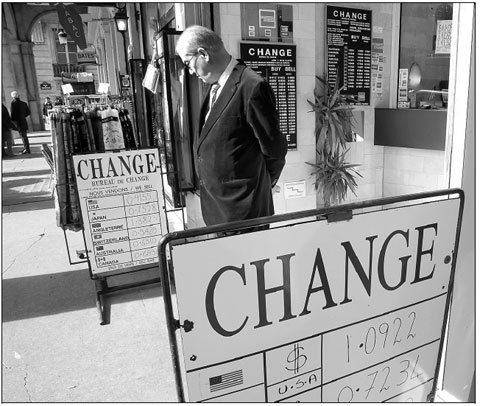

A man looks at an exchange rate board in Paris. The euro could soon be doing something it's only done a couple of times in its 16year existence, trading 1to1 with the dollar. Europe's single currency has since May been on a downward trajectory against the dollar, mainly because of the divergence in economic performance between the eurozone and the United States. Michel Euler / AP |