China, US should transcend economic fears

In his inaugural address of 1933, Franklin D. Roosevelt famously said that, "the only thing we have to fear is fear itself". Those words provide guidance to the upcoming summit between Chinese President Xi Jinping and his US counterpart Barack Obama, which takes place under deepening economic challenges.

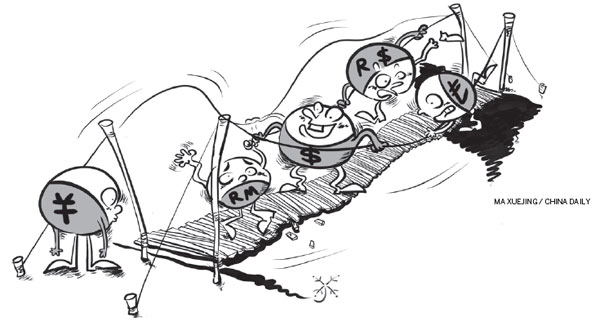

In the US, the concern is that China's exchange rate adjustment could trigger a global currency war. In China, the concern is that the US Federal Reserve's impending rate hikes could trigger detrimental capital outflows.

On Aug 11, the People's Bank of China made a change to the central parity of the renminbi against the US dollar to better reflect market conditions. The net effect was a depreciation of 1.9 percent relative to the US dollar. After a decade, the renminbi, unlike the BRIC currencies, had appreciated 30 percent against the US dollar. A re-adjustment was required; depreciation was its side effect.

Nevertheless, many US observers saw the PBoC's decision as a signal that China's deceleration is worse than anticipated. And yet, in the medium term, China's rebalancing is proceeding as anticipated, as the International Monetary Fund has acknowledged. In the near term, that does mean growth deceleration and occasional market volatility.

Other US observers argued that the devaluation may initiate new phase in global currency war. In reality, currency frictions escalated already in 2009-10 after advanced economies cut their interest rates close to zero, while launching rounds of quantitative easing. Recently, these frictions have been amplified by the strengthening of the US dollar, the fall of the euro, and the plunge of the dollar-denominated commodity markets.

Still others alleged Beijing planned to use its cheaper currency to jumpstart exports and growth. But that makes no sense in the light of China's ongoing rebalancing away from net exports and investment. Any real effort to boost export-led growth would require at least 15-30 percent depreciation; 2 percent is grossly inadequate for the purpose.

Finally, some observers saw the PBoC's decision as an effort to comply with the IMF's conditions to include the renminbi in the Special Drawing Rights reserve currency basket. This move toward a more market-determined rate is well aligned with China's policies and precisely what the IMF and the US Treasury have been asking for.

That's not exactly a portrait of a country intent on causing havoc in global currency markets.

After the equity market turmoil in the US and globally, the conventional wisdom is that the Fed will hike the interest rates in the fall, which is expected to unleash potentially adverse capital outflows.

US growth has averaged about 2.1 percent over the past three years, while unemployment is at a seven-year low of 5.3 percent. Yet long-term unemployment is worse than at any point of time since the 1940s, and the labor participation rate is as low as in the dismal 1970s.

Inflation remains pretty far from the Fed's rate-hike target of 2 percent. In the first half of the year, the US economy was haunted by disinflation. In the second half, inflation will remain around 0.5-1 percent - in a benign scenario.

Against this backdrop of slow growth and failing inflation, a premature decision to hike rates could undermine US growth prospects and the Fed's own credibility while imposing a series of new rate cuts in due time.

What further complicates the Fed's task is the soaring US sovereign debt. Despite all the rhetoric of deleveraging, that debt burden is now close to $18.4 trillion, which exceeds the size of the economy. As the Congress has failed to pass a budget for the coming fiscal year, it has elevated the risk of still another government shutdown in October.

That's not exactly a portrait of a nation amid vibrant economic recovery.

Indeed, China's economy may be more resilient, and US economy more fragile than conventional wisdom currently presumes.

What the two great nations need is not fear about each other's real or perceived weaknesses, but confidence about their respective strengths.

The author is research director of international business at the India China and America Institute (US) and a visiting fellow at the Shanghai Institutes for International Studies (China) and the EU Centre (Singapore).