|

An increasing number of European countries have been preparing, if not actually having begun, to embrace China's investors for a larger volume of deals in the years to come. Provided to China Daily |

Opportunities exist in several sectors, but road ahead is not easy, say analysts

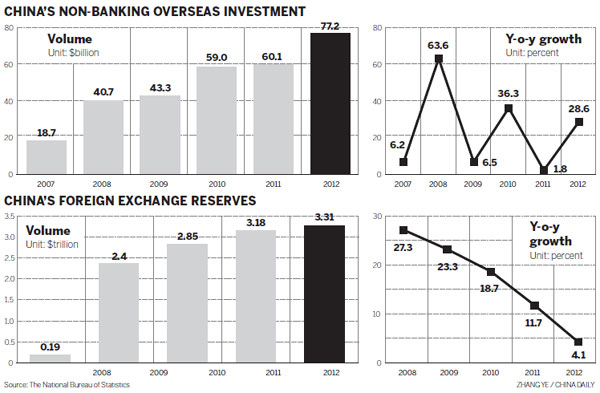

With increasing investable assets, stable macroeconomic fundamentals and policies to invest outside China, the nation has become a widely welcomed source of investors, whether they are focused on direct investment or financial products in European countries.

Although Chinese investment in Europe is still in its infancy, it will definitely increase, according to Davide Cucino, president of the European Union Chamber of Commerce in China.

"Over the coming years the demand for European products, technologies and brands will continue to grow," said Cucino.

By 2020 China will be the first or second largest consumer market in the world. A strong push to become an innovative and environmentally sustainable economy will impel the country to continue to attract and strengthen the transfer of technology or to buy outright foreign technologies, he said.

An increasing number of European countries have been preparing, if not actually having begun, to embrace China's investors for a larger volume of deals, said people who monitor such developments.

Belgium scenario

Long known as the heart of Europe, Belgium is host to the headquarters of the European Union, an economic and political union of 27 member states, and is regarded as a political, trading and cultural center of the continent.

Proximity to Brussels allows foreign investors to directly monitor EU regulations and get immediate access to EU research and development grants, said Albert Wolfs, head of the Belgian Ministry of Finance's fiscal department for foreign investment.

According to a KPMG study in December, Belgium is the fourth largest exporter of goods worldwide in terms of gross domestic product percentage and the second largest conference center in terms of the numbers of meetings held every year.

There are solid reasons to invest in Belgium because it allows 100 percent foreign ownership and no limitations are required on repatriation of capital and benefits, Wolfs said.

China has become Belgium's second largest trading partner outside the EU, with a bilateral transaction volume of $29 billion in 2011, up by 31.5 percent.

The top five imported goods from China are electrical equipment, machinery, steel, organic chemicals, textiles and clothes.

"China has been strongly increasing its outbound foreign direct investment to Belgium. Chinese and Belgian sovereign funds work together to help Chinese companies invest in Europe," said Huang Weihua, senior manager for China practice at KPMG's Brussels office.

According to Huang, Chinese companies that established a foothold in Belgium are from a wide range of sectors including automotive, logistics, banking, telecoms and services.

Recent years have witnessed a clear, rising interest from Chinese companies in cross-border mergers and acquisitions, in addition to green-field investment, Huang said.

For instance, Sinochem Group acquired 35 percent of the equity in Belgium-based agro-industrial firm SIAT NV in 2012 and Huawei Technologies acquired a 100 percent stake in the telecom equipment provider M4S NV in 2010, making it a fully owned subsidiary.

Belgium has extended a series of policy incentives to attract foreign companies, Huang said. According to local laws, an EU holding company in Belgium can benefit from an exemption enabling the withholding of tax on dividends paid to its affiliated companies in the EU and in jurisdictions with which it has tax treaties.

Companies also do not have to pay taxes on the payment of interest and royalties, 95 percent of the dividend received and enjoy total exemption from capital gains on shares.

According to the EU's Institute of International and European Affairs, the effective corporate tax rate in Belgium is around 4.8 percent, much lower than most EU countries. For example, the rate in the United Kindom is 23.2 percent and in Germany it is 22.9 percent.

Funds marketing

For European companies and institutions, marketing is essential in Asia, said Ching Yng Choi, head of the Asia Representative Office with the Association of the Luxembourg Fund Industry.

There are no uniform standards for strategy and it is not easy to expand distribution channels when knowledge about the market is limited. It is vital to establish connections to distribute products, said Choi.

In Asia, individual investors tend to choose cash deposits instead of investing in funds. Even if they invest, most want to try their luck in the stock market instead of choosing long-term investment products.

These days investors are interested in other options, said Choi. Specialized investment funds are enjoying a great performance despite being subjected to regulations that limit investment and private ventures are also popular.

European countries are making great efforts to market the Undertakings for Collective Investment in Transferable Securities to buyers in China, one of several countries with a great potential to buy. UCITS are a set of European Union directives that aim to allow collective investment schemes to operate freely throughout the EU on the basis of a single authorization from one member state. Critics say that in practice many EU member nations have imposed additional regulatory requirements that have obstructed their free operation to protect local asset managers.

As the European economy struggles to recover, the net sales of UCITS in 2012 reached 201 billion euros while inflows across Europe returned to positive territory on the back of strong demand, according to statistics compiled by the European Fund and Asset Management Association.

Long-term UCITS also returned to positive territory, registering net inflows of 239 billion euros compared with outflows of 64 billion euros ($82 billion) in 2011.

By the end of the year, total investment fund assets accounted for 62 percent of the EU's GDP, while total investment trust assets increased 12.4 percent to 8,944 billion euros.

Emerging markets

Growth in assets under management will be higher in developing Asian markets, including the Chinese mainland, Indonesia, Malaysia and Thailand, than in mature markets such as Singapore, Hong Kong, Taiwan and South Korea, according to a recent study published by Fitch Ratings.

Emerging markets in Asia have a large and growing middle class population with low penetration of managed products at 5 percent of total financial assets on average compared with 15 percent in Western countries, the report said.

Despite the fact China has suffered from a five-year sluggish stock market and an under-developed debt market until recently, analysts believe that a stabilization or rise in equity markets and recent regulatory initiatives to expand Chinese capital markets will allow the gap to be closed during the next few years.

"East Asia represents a growth opportunity for international asset managers but distribution in the region is not straightforward," said Aymeric Poizot, managing director of Fitch's Fund and Asset Manager Rating Group.

"The cross-border wealth management and institutional segments are very competitive while, in retail, large consumer banks dominate distribution in most countries - making distribution agreements critical," said Poizot.

Historically, foreign funds have been distributed in Singapore, Hong Kong, South Korea and Taiwan, notably through private banks, wealth managers or financial advisers. As hubs, Hong Kong and Singapore account for $2 trillion of offshore funds' assets under management, largely consisting of European UCITS funds, the number of which has grown to reach around 6,000 funds in 2012.

China and South Korea dominate the $1 trillion domestic onshore market in East Asia but emerging Asia already accounts for 15 percent of the region's onshore assets under management and continues to grow fast.

"Domestic funds exhibit a bias toward core fixed income products and 2012 flows have continued to favor bond and money market funds. Multi-asset and internationally exposed funds are likely to attract growing flows in the coming years in Asia as in other regions because they offer more diversification," Poizot said.

Investment options

Some European countries are offering more options for fund managers than before.

"In Luxembourg we have various choices to cater to demand from Chinese investors," said Stephane Karolczuk, head of the Hong Kong office of Arendt & Medernach, Luxembourg's largest independent law firm.

In addition to UCITS, the Alternative Investment Fund Managers Directive may enable fund managers to consider other options such as the Specialized Investment Fund, the Undertaking for Collective Investment and the Investment Company in Risk Capital, which provide flexibility to investors, said Karolczuk.

At the same time, China's asset managers are seeking development away from their home country. The long-term strategy is to develop overseas distribution networks.

To be a global player, asset managers need to have their goods exposed widely in the global market and issue products that can be widely accepted, said Nocals Papvoine, a lawyer with the UK-based law firm Allen and Overy.

China's investors need to be exposed to more structured investment vehicles, said Thierry Lohest, a lawyer with the Netherlands-based law firm Loyens and Loeff.

Anyone who reads a Chinese newspaper will be amazed at the large number of property ads but people are inclined to save money in their bank accounts.

"We must persuade people that there are other investment procedures that can bring higher yields but it is not easy at the current stage," said Lohest.

He Wei contributed to this story.

wuyiyao@chinadaily.com.cn

(China Daily 04/15/2013 page13)