|

A senior citizen examining gold necklaces at a department store in Nanjing, capital of East China's Jiangsu province. Many senior citizens believe that it is an opportune time to buy the yellow metal as prices have plummeted to a historical low in over 30 years. Provided to China Daily |

|

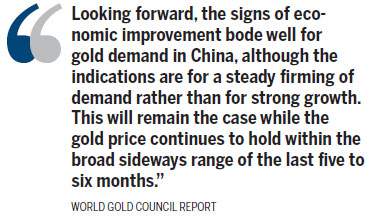

Falling gold prices have been a major catalyst for triggering investor concerns in the global market. On April 15 gold for June delivery on the Comex division of the New York Mercantile Exchange was down $74.50 or by more than 5 percent at $1,406.90 per ounce with lowest point reaching $1,363.5 per ounce, the sharpest two-day tumble since 1983. Provided to China Daily |

Bars and coins remain the most popular products for long-term investments

It has been more than two weeks since Liu Chan, a gold product manager working in Shanghai, has enjoyed a quiet weekend at home. The 32-year-old gold product consultant with a Shanghai-based bank said investors' increasing passion for gold coins and bars has kept her on the phone answering inquiries from more than 20 clients a day.

A powerful trigger for their desire to buy the yellow metal is its falling price in the global market, sparking interest in a market regarded by many as a haven in troubled financial times. On April 15 gold for June delivery on the Comex division of the New York Mercantile Exchange was down $74.50 - more than 5 percent - at $1,406.90 an ounce. Its lowest point was $1,363.5 an ounce, the sharpest two-day tumble since 1983. Spot gold prices fell by more than $100 an ounce - 8.7 per cent - in a few hours on April 15 amid a rout in the metals markets.

In China, the price of gold dropped by the daily limit for two consecutive days on April 15 and 16 on the Shanghai Gold Exchange following a slump in international prices.

Gold jewelry stores in Shanghai, Beijing, Wuhan and Nanjing reported gold jewelry and bullion bulk buying. In Beijing, staff at a gold shop said customers came from all across the city and bought a combined 20 kilograms of gold within a couple of hours in just one day, according to a China Central Television report.

"It seems that investment in gold is getting popular as investors attach increasing importance to hedging risks in their portfolios and are passionate about buying when the price is dropping," said Liu.

Robust outlook

Despite challenging domestic economic conditions, China, alongside India, remains a global gold power house, according to Marcus Grubb, managing director of the investment department at the World Gold Council.

"Notwithstanding the predicted economic slowdown in China, investment demand was up 24 percent in the fourth quarter on the previous quarter," said Grubb referring to one of the latest reports on trending in gold demand.

The latest statistics from the World Gold Council show that in China investment in gold reached 265.5 tons in 2012, a healthy level of demand, and the recovering economic situation in the country may see more demand for gold investment this year.

Grubb said China is still among the countries with the highest demand for gold in the world despite its slowing but nonetheless significant economic growth. A recovering economy may see more demand for gold in 2013.

"Looking forward, the signs of economic improvement bode well for gold demand in China, although the indications are for a steady firming of demand rather than for strong growth. This will remain the case while the gold price continues to hold within the broad sideways range of the last five to six months," the council report said.

Xue Ke, chief analyst and deputy general manager with Tianjin Jinhengfeng Precious Metals Management Co, said investors in China need to clarify their investment goals before they can make a reasonable choice for their portfolios.

Because the infrastructure surrounding the trading of gold is yet to mature in China, an emerging market, the market's pricing power for gold is relatively weak compared with that of mature markets. China's investors need to consider global economic and political situations, elements that may affect gold prices, said Xue.

"Investors need to study the pricing mechanism of gold - both spot and future prices - and decide whether they are going to speculate short-term or are eyeing long-term value growth," said Xue.

Despite numerous headwinds, emerging markets, responsible for the majority of physical gold demand, are showing signs of improvement, according to the council.

Returning to stability

Among all the precious metals, gold remains investors' favorite. They have significantly less zeal regarding other options such as silver, according to Thomas Cheong, vice-president of the wealth management department at Manulife Financial China operations.

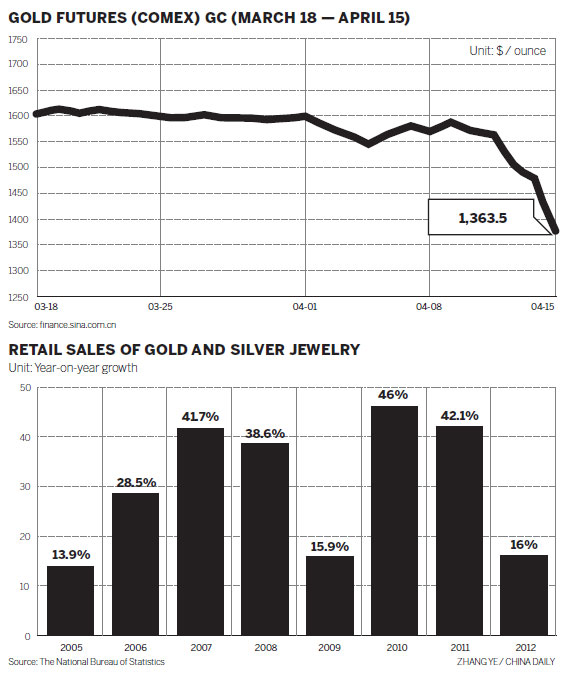

Over the last two years Chinese buyers of gold have displayed a remarkably consistent attitude toward the metal: Demand for investment and jewelry throughout 2012 has shown little variation over 2011 quarterly levels.

Gold demand came under pressure from a variety of opposing forces in 2012, with the net result that quarterly year-on-year changes have been less than significant. Tailwinds propelling Chinese demand included the continued urbanization of the population, the dominance of 24-carat (pure) gold and its role as a savings proxy and increasing availability of gold investment products to a population with a growing awareness of gold's investment properties - particularly its role as an inflation hedge, according to a World Gold Council analysis.

According to statistics compiled by the council, in volume terms, Chinese gold demand can best be described as stable, a minor increase in investment demand being slightly overshadowed by a moderation in jewelry demand. Total customer demand was valued at 262.7 billion yuan ($42.2 billion) in 2012, an increase of 3 percent over the previous year, as people in China continued to allocate greater sums to their gold investment and jewelry purchases. Demand in both sectors reached a record value in 2012.

Gold bars and coins remain the most popular gold investment products, said Gu Xiaochao, a sales manager with China Construction Bank.

"China's investors have a long history of using gold as a tool to hedge financial risks. It is understandable that when people see something as a guarantee of financial safety and stability, they like to see and touch it," said Gu.

The sales manager added that after the media exposed the fact some jewelry brands sell products made with iridium but claim they are pure gold, investors have become more cautious about purity when buying the metal. However, there has not been much of an effect on investment demand.

"We still have clients popping up to buy scores of gold necklaces or handfuls of gold rings. Investment in gold jewelry is as popular as ever," said Yan Fang, a sales consultant at a gold store in Shanghai's Yu Garden - one of the city's gold jewelry hubs.

Sun Taoxian, a 45-year-old physician in Shanghai, said she puts about 10 percent of her savings in gold bars. She rents a safety deposit box to store them.

Sun said she is one of many middle-class investors who have tried a large variety of wealth management products since the early 1990s - trading in the stock market, buying and selling foreign exchange, investing in trusts and funds, but she has found gold is the most stable and "safe".

Over the past decade, people have been eyeing high-yield products and hoping to become rich overnight, seeing assets doubling or tripling in a couple of months through speculation on the stock market or gaining a 20 percent yield in trading foreign exchange, but after all these years, investors are getting smart and mature and want slower but safer returns, said Sun.

"If you look at the return on gold investment over a 10-year-term, you'll find that it's actually very good, double that of many fixed-income products," said Sun.

Xue, the analyst with Jinhengfeng, said one reason for the falling price of gold in the global market is the shift of funds from the precious metal to the recovering stock market in the US and reduced concerns about the economic situation as the macro picture improves.

The hedging value of gold may be weakened in the short term but its long-term value for hedging risk is inherent, said Xue.

Continued innovation in the range of gold investment products available across a range of countries including gold accumulation plans in China confirms the healthy appetite for gold among investors, said Yang Yijun, chief analyst with Wellxin.com, a precious metals consultancy.

Gold exchange-traded funds, likely to be introduced this year, could further push up demand for gold reserves in China, said Yang.

Although currently there is no official timetable for gold exchange-traded funds in China, authorities have been making efforts to bring the gold investment market closer to the global gold market.

Yang Fei, an analyst at Seewonder Financial in Shanghai, said investors are also increasingly interested in gold-backed financial derivatives.

"It takes more experience, knowledge and guts to deal in gold-backed funds and, interestingly, more investors are working hard to expand their vision for investment in gold," said Yang.

wuyiyao@chinadaily.com.cn

(China Daily 04/22/2013 page13)