Exchange rate reform puts the seal on yuan's advance

On the second anniversary of the Chinese mainland's exchange rate reform, the market is still quivering over the yuan's single day fall of 1.87 percent against the US dollar, triggered by the central bank's abrupt decision on August 11, 2015 to reform the renminbi's midpoint rate determination mechanism.

But, financial experts have hailed the move by the People's Bank of China (PBOC) as a positive effort to push the yuan onto the global stage.

The market-oriented reform, while pegging the yuan against a basket of currencies, rather than the greenback, not only contributes to the stabilization of the currency in the longer term, but also marks a milestone in renminbi's internationalization, said Cheng Shi, chief economist at ICBC International.

"The market calls for a multilateral global currency regime. But, we don't need another shadow currency of the US dollar, such as the Hong Kong dollar. To qualify as a world currency, its formation mechanism should be endogenously driven, thus, detaching itself from the US dollar is a big step toward renminbi going global."

The momentum in China's long-term goal to make the yuan a global currency, which seemed to have slowed down in the past two years amid depreciation pressure, has picked up this year with the currency having stabilized.

According to the Society for Worldwide Interbank Financial Telecommunication (SWIFT) RMB tracker, the yuan's share as an international payment currency had fallen from 2.31 percent in 2015 to 1.68 percent late last year. But, RMB bounced back in May this year as the sixth most active currency for global payments, with a 1.61-percent share - a slight increase from 1.60 percent in April. The US dollar still held a dominating share of 42.09 percent in international payment as of late last year.

Cheng noted there's still no consensus on concrete indications of a "world currency" status, saying the market won't have "strong feelings" of RMB internationalization until the currency had hit 20 percent in international trades and payment. The process has a long way to go, but he sees a steady upward trend buttressed by the mainland's economic strength.

"In the next 10 years, China will be transforming from the world's second-largest economy to the biggest - that's a precondition for the yuan's internationalization."

According to the World Bank, the US gross domestic product in 2016 stood at $18.57 trillion, while that of the Chinese mainland was $11.2 trillion. The gap is narrowing as China is growing at a rate of 5 to 6 percent annually compared with 2 to 3 percent for the US, said Cheng.

The mammoth China-led Belt and Road (B&R) Initiative also testifies to the fact that the mainland is transforming from trade driven to investment driven in the yuan's internationalization process, he pointed out.

The yuan has hit a new high against the US dollar this year, reaching 6.7251 as of July 27 -the strongest in nine months since October 14, 2016. The mainland has seized the opportunity to launch various policies to open up its capital account and accelerate the currency's going global effort. And, Hong Kong is playing a major role as the biggest offshore renminbi center.

In January this year, the PBOC issued a document entitled "Matters Concerning Cross-Border Finance and Its Macro-prudential Management", which promoted the flow of funds into the mainland by raising the leverage ratio of cross-border financing from 1 to 2.

The Bond Connect - the third securities trading link between Hong Kong and the mainland that allows purchases of Chinese bonds in Hong Kong - kicked off on July 3, with 7 billion yuan ($1 billion) of trading on its launch day, according to the central bank.

A day later, the State Council raised Hong Kong's Renminbi Qualified Foreign Institutional Investor (RQFII) quota from 270 billion to 500 billion yuan.

"The opening up of the domestic bond market is a key sign of a currency's internationalization. The scheme offers a new avenue for foreign investors to buy Chinese bonds and hold yuan-denominated assets, which will also elevate renminbi's status as a reserve currency," said Ying Jian, senior economist at Bank of China (Hong Kong).

Since the International Monetary Fund began tracking renminbi in global foreign currency reserves, the amount had surged from $84.435 million in the fourth quarter of 2016 to $88,535 in this year's first quarter, accounting for 1 percent of allocated reserves.

With the opening up of the stock, bond and gold markets, Ying said the next step is to give foreign investors access to the commodities and derivatives markets, stressing that integrating the domestic market with the rest of the world is crucial to renminbi going global.

The mainland opened its gold market in September 2014 when the Shanghai Gold Exchange set up an international board. Foreign investors can open trading accounts denominated in renminbi in Shanghai's free-trade zone and trade directly through the board. The country's commodity exchanges remain reserved for domestic investors.

Hong Kong, as the biggest offshore renminbi center with more than 70 percent in offshore renminbi payments, has a role to play in accelerating the process.

Cheng and Ying agreed that Hong Kong should get more involved in the country's mammoth projects, like the B&R Initiative.

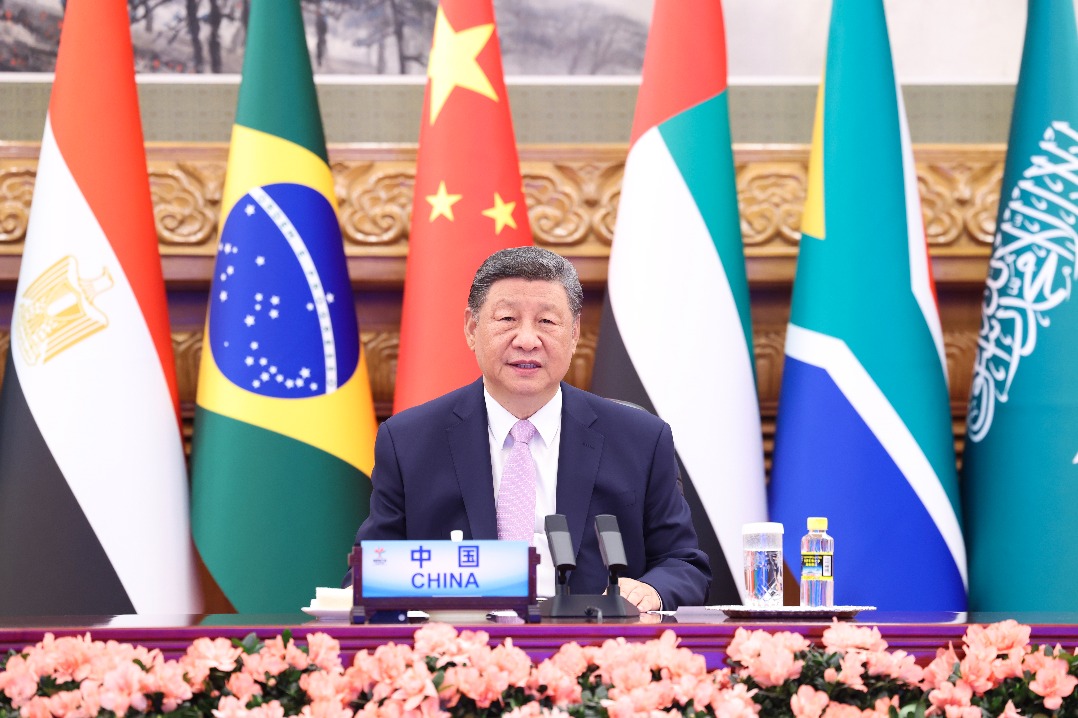

President Xi Jinping told the Belt and Road Forum for International Cooperation in May that China would contribute more than 840 billion yuan to the B&R project through the Silk Road Fund and offer special renminbi loans, offering strong impetus for international use of renminbi.

Lobbying various B&R funds to open up offices in Hong Kong and improving clearing services and systems are plausible ways that Hong Kong can adopt to win a bigger role in promoting renminbi internationalization.

But, in Ying's view, there's still a long way to go in renminbi internationalization. The ultimate goal can be achieved given the mainland's rising economic clout. The process may see twists and turns, but the upward trend is unchanged.

evelyn@chinadailyhk.com

(HK Edition 08/11/2017 page7)

Today's Top News

- Huangyan approved as nature reserve

- Establishment of Huangyan Island nature reserve safeguards its marine environment

- Defense minister: Containment efforts unworkable

- Huangyan Island National Nature Reserve gets official go-ahead

- Defense leaders from over 100 countries to attend Xiangshan Forum

- China honors model teachers in celebration of Teachers' Day