Fed move helps create brighter picture for investors

The US Fed rate hike would have a mild and positive effect on China's capital markets, as investors' positive sentiments grow and they have more confidence in yuan-denominated assets, analysts said on Thursday.

Analysts said because the widely expected hike had now materialized, uncertainties about it had disappeared, which would benefit China's capital markets.

The US Federal Reserve voted to raise the range of the federal funds rate to 0.75 percent and 1 percent due to better-than-expected employment figures and improved overall market sentiment.

"This is not just a sign of US recovery. It influences global market investors' confidence positively," said CITIC Securities Co in a research note.

"There won't be concerns about capital flowing into the US market from China, because the fundamentals in China, the world's second-biggest economy, are also improving."

Founder Securities Chief Economist Ren Zeping said in a research note that the hike pointed to stronger economic fundamentals, and for China the spillover effect may include greater stability in the yuan-dollar exchange rate.

"Recovering fundamentals, alongside growing domestic demand and global demand, will have a positive effect on the A-share market," Ren said.

"The shares of companies which have been undervalued over the past few months present real opportunities, as those prices are corrected to more rational levels."

In the longer term, a stronger yuan and neutralized currency policies would also benefit yuan-denominated assets, including the A-share and bond markets, according to Qian Jun, a professor of finance at the Shanghai Advanced Institute of Finance.

Earnings from the bond market could increase, despite the fact that China's bond market is already outperforming many other markets, as the bond market tracked fundamentals more closely than ever, said a research note from Bosera Asset Management Co.

Zhou Wenyuan, a senior analyst at Guotai Jun'an Securities Co, said key factors influencing returns on the bond market were the CPI and PPI, and policy making in China's domestic market.

"The Fed rate hike's effect on China's bond market will be mild and short-term, which is already reflected in the 15 basis points gain in Thursday trading," he said.

A bond connect plan that links the bond markets of Hong Kong and the mainland, which is expected to be introduced by the end of 2017, will act as a bilateral investment flow mechanism that is significant for onshore investors, said Moody's Associate Managing Director Ivan Chung.

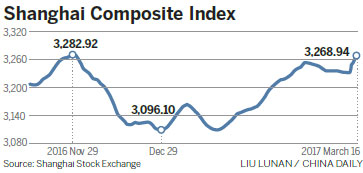

The benchmark Shanghai Composite Index rose 0.85 percent on Thursday to 3,268.94 points, its highest level in three months, and 10-year treasury bond futures rose 0.7 percent to 96.355 points, a two-month high.

wuyiyao@chinadaily.com.cn