Shopper convenience, user experience and brands' need for ubiquity drive change

China may have emerged the world's largest consumer market by 2016-end, but it's only recently that steps to revolutionize the retail-scape have accelerated, with merchants and brands hailing the dawn of so-called 'New Retail', according to consultancy eMarketer.

New Retail is a term that roughly indicates a combination of the best in physical and online retail. In the words of Jack Ma, founder and chairman of e-commerce behemoth Alibaba Group Holdings Ltd, New Retail is making the distinction between physical and virtual commerce obsolete.

A latest example is a strategic partnership announced in February between Alibaba and Balilian Group Co Ltd, a retail conglomerate headquartered in Shanghai. Under the deal, the duo would leverage their troves of consumer data in order to integrate offline stores, merchandise, logistics and payment tools to deliver a better overall shopping experience.

Specifically, Alibaba and Bailian would co-design brick-and-mortar stores that merge online and offline shopping experiences, and combine membership bases to deliver enhanced customer services through technologies such as geo-location, facial recognition and big data-driven customer management systems.

There are also massive changes coming up in payment and customer loyalty programs. Alipay, the digital wallet under Alibaba affiliate Ant Financial, will be accepted across 4,700 Bailian stores across 200 Chinese cities and regions. And Bailian's indigenous prepaid cards can be integrated into Alipay as a payment option.

This is the second major push of Alibaba this year to digitize offline malls and fuel growth on the increasingly saturated online traffic. In January, it led a $2.6 billion bid to privatize Hong Kong-listed Intime Retail Group Co Ltd. Its biggest investment so far in merging online and offline resources came in 2015, when it poured $4.6 billion in electronics chain Suning Commerce Group Co Ltd.

Alibaba's archrival JD, the nation's second-largest online marketplace, has joined the ranks and opened three offline outlets at Yonghui Superstores in Beijing, in which the e-commerce firm has a 10 percent stake.

It opened stores even in lower-tier cities across China, but instead of a physical showroom of products, they mostly serve as distribution, delivery and after-sales maintenance centers for home appliances.

JD also neatly took a lead by allowing delivery of online orders for fresh, chilled and frozen produce to existing convenient stores, from which the "last mile" delivery could be made to the customer's door (or collected in-store), once the time and place had been confirmed.

Not just internet players, even traditional malls are stepping up efforts to merge their offline and online resources.

In March, China's top conglomerate Wanda Group joined hands with card processor China UnionPay, where all Wanda partner merchants would co-develop a UnionPay cardholder service system, mobile apps and marketing campaigns that serve shoppers across all Wanda properties.

New Retail is the result of efforts to find solutions to a key set of problems for each side, said Matthew Crabbe, research director at consultancy Mintel for Asia Pacific.

"For the physical store chains, they have been unable to keep up with the growth of online retail. For the online operators, they have struggled to keep delivery infrastructure capacity up with the rapid growth in online shopping demand," he said.

New Retail means more connection and integration - not just for retailers but also consumers, manufacturers and other industry players, said Vishal Bali, managing director of Nielsen China.

"It is improvement of developed technology, consumers getting sophisticated, and diversification of industry and platform," Bali said.

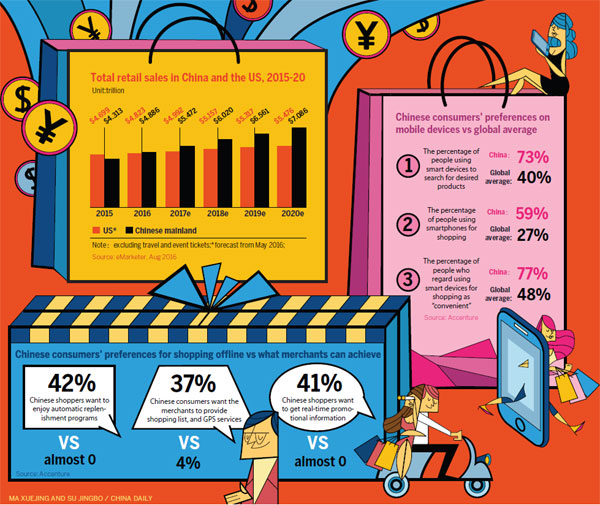

The adoption of mobile devices is a major factor in New Retail. By the end of 2016, mobile commerce accounted for 55.5 percent of all retail e-commerce in China, said eMarketer. It also forecast sales via mobile commerce will likely reach $1.5 trillion in 2019, representing a quarter of the country's overall retail market.

China has overtaken the United States to become the largest mobile payments country, partly thanks to its late-mover advantage. Compared with other developed countries, China does not have an entrenched credit culture and has no problem jumping from cash to mobile payments.

As brick-and-mortar retailers seek to turn their physical stores into an asset instead of a liability to compete against online retailers, they need to heed the demands of today's increasingly mobile phone-dependent consumers, said Andria Cheng, an analyst at eMarketer.

The International Council of Shopping Centers said in a March report that more than three-fifths of 1,200 surveyed consumers said that by 2020 they actually prefer to be left alone to do their own thing while in stores, instead of engaging with a salesperson, as long as the store provides easy access to products and navigable online tools.

Consultancy Accenture agreed. It found that over three quarters of Chinese shoppers prefer to use mobile devices when they make a purchase, 30 percentage points higher than the global average.

Changing consumer behavior is also stoking New Retail. The survey indicated a consumer preference for online-to-offline or O2O channels, with people saying that before making a purchase, they want to virtually see how furnishings and accessories would look in their home.

Separately, more than half said they want to compile a shopping list on a store app and receive a floor map to locate products.

Merchants will need to step up their focus on new ways of engagement to attract and retain younger buyers, who are looking for enhanced digital tools that facilitate their purchases, said Yew Hong Koh, managing director of consultancy Accenture's APAC Retail Lead.

By studying 10,000 people across 13 countries including China, Accenture found that nearly three-quarters of young shoppers are interested in curated subscription-type offerings for fashion. The respondents said they are inclined to turn to merchants that offer such services.

In China, too, three-fourths of respondents said social media networks such as WeChat and Weibo exert a major influence on their shopping habits, according to the study.

As "visual animals", they like video sharing and normally turn to their "influencer" circles - that is, comments on social media and from family and friends, before making a purchase, Koh noted.

How are brands responding?

The ubiquity of smartphones has allowed retailers to engage consumers via the internet while they're on the go, and merchants should use that engagement to drive them into their bricks-and-mortar stores, said Xu Jian, analyst at consultancy Kantar.

Standardized products are among the first batch to embrace the omnichannel strategies, because of lower threshold for logistics and storage, he said.

So brands in the beauty sector are in the forefront. Upon the opening of its Tmall store, France's Guerlain used a live-streamed broadcast on Tmall to secure 50,000 followers for its newly launched store, and has generated over 4 million "likes" and comments, according to Alizila, Alibaba's company news portal.

hewei@chinadaily.com.cn