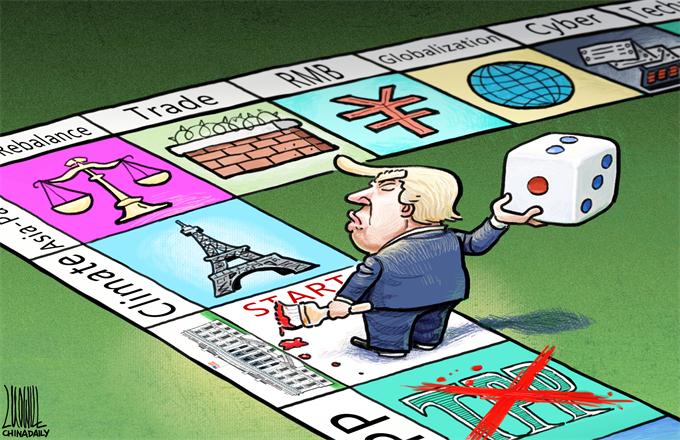

The dangers of US' strategy vacuum

Apparently, policymakers at the US Federal Reserve are having second thoughts about the wisdom of open-ended quantitative easing. They should. Not only has this untested policy experiment failed to deliver an acceptable economic recovery; it has also heightened the risk of another crisis.

The minutes of the Jan 29-30 meeting of the Fed's Federal Open Market Committee speak of a simmering discontent: "(M)any participants expressed some concerns about potential costs and risks arising from further asset purchases." The concerns range from worries about the destabilizing ramifications of an exit strategy from QE to apprehension about capital losses on the Fed's rapidly ballooning portfolio of securities (currently $3 trillion, and on way to $4 trillion by the end of this year).

As serious as these concerns may be, they overlook what could well be the greatest flaw in the Fed's unprecedented gambit: an emphasis on short-term tactics over longer-term strategy. Blindsided by the crisis of 2007-08, the Fed has compounded its original misdiagnosis of the problem by repeatedly doubling down on tactical responses, with two rounds of QE preceding the current, open-ended iteration. The FOMC, drawing a false sense of comfort from the success of QE1 - a massive liquidity injection in the depths of a horrific crisis - mistakenly came to believe that it had found the right template for subsequent policy actions.

That approach might have worked had the US economy been afflicted by a cyclical disease - a temporary shortfall of aggregate demand. In that case, counter-cyclical policies - both fiscal and monetary - could eventually be expected to plug the demand hole and get the economy going again, just as Keynesians argue.

But the United States is not suffering from a temporary, cyclical malady. It is afflicted by a very different disease: a protracted balance-sheet recession that continues to hobble American households, whose consumption accounts for roughly 70 percent of GDP. Two bubbles - property and credit - against which American families borrowed freely, have long since burst. But the aftershocks linger: Household-debt loads were still at 113 percent of disposable personal income in 2012 (versus 75 percent in the final three decades of the 20th century), and the personal savings rate averaged just 3.9 percent last year (compared to 7.9 percent from 1970 to 1999).

Understandably fixated on balance-sheet repair, US consumers have not taken the bait from their monetary and fiscal authorities. Instead, they have cut back on spending. Gains in inflation-adjusted personal-consumption expenditure have averaged a mere 0.8 percent over the past five years - the most severe and protracted slowdown in consumer demand growth in the post-World War II era.

The brute force of massive monetary and fiscal stimulus rings hollow as a cyclical remedy to this problem. Another approach is needed.

The focus, instead, should be on accelerating the process of balance-sheet repair, while at the same time returning monetary and fiscal policy levers to more normal settings. Forgiveness of "underwater" mortgages (where the outstanding loan exceeds the home's current market value), as well as reducing the foreclosure overhang of some 1.5 million homes, must be part of that solution. How else can the crisis-battered housing market finally clear for the remainder of US homeowners?

The same can be said for enhanced savings incentives, which would contribute to longer-term financial security for American households, most of which suffered massive wealth losses in the "Great Recession". Expanded individual retirement accounts and 401K pension schemes, special incentives for low-income households (most of which have no retirement plans), and an end to the financial repression that the Fed's zero-interest-rate policy imposes on savers must also be part of the solution.

Yes, these are controversial policies. Debt forgiveness raises thorny ethical concerns about condoning reckless and irresponsible behavior. But converting underwater "non-recourse" mortgage loans, where only the house is at risk, into so-called "recourse liabilities", for which nonpayment would have consequences for all of a borrower's assets, could address this concern, while simultaneously tempering America's culture of leverage with a much greater sense of responsibility.

Timing is also an issue, especially with respect to saving incentives. To avoid the shortfall in aggregate demand that might arise from an abrupt surge in savings, these measures should be phased in over a period of three to five years.

The main benefit of these proposals is that they are more strategic than tactical - better aligned with the balance-sheet problems that are actually afflicting the economy. As the quintessential laissez-faire system, the US has outsourced strategy to the invisible hand of the market for far too long. That has left the government locked into a reactive and often misguided approach to unexpected problems.

Thus, the Fed is focused on cleaning up after a crisis rather than on how to avoid another one. The same is true of the US fiscal policy, with an event-driven debate that now has ever-shorter time horizons: the fiscal cliff on Jan 1, sequestration of expenditures on March 1, expiration of the continuing budget resolution on March 27, and the new May 18 debt-ceiling limit. A compliant bond market, which may well be the next bubble, is mistakenly viewed as the ultimate validation of this myopic approach.

The dangers of America's strategy vacuum and the related penchant for short-termism have been mounting for some time. The internal debate in the FOMC represents a healthy and long-overdue recognition that the US central bank may be digging itself into an ever-deeper hole by committing to misguided policies aimed at the wrong problem. A comparable debate is raging over fiscal policy. Can the US finally face up to the perils of its strategy vacuum?

Project Syndicate

The author is a faculty member at Yale University and former Chairman of Morgan Stanley Asia.

(China Daily 03/02/2013 page5)