|

|

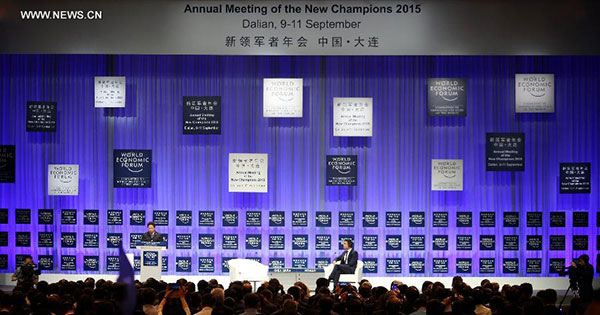

The opening plenary of the 2015 New Leaders Meeting of the World Economic Forum (WEF) is held in Dalian, northeast China's Liaoning Province, Sept 10, 2015. [Photo/Agencies] |

China seems to be in the same position, economically speaking, that Japan was in the early 1970s. Japan relied heavily on exports to register extraordinary growth in the 1950s and 1960s. But its growth was halted by the 1973 oil crisis, which also had a devastating effect on the world market. During the next decades, Japan’s GDP grew 3.4 percent a year, barely 40 percent of the average rate it had achieved in the 20 before the oil crisis. And when its real estate bubble burst in 1993, Japan’s GDP began a long period of virtually zero growth, with its domestic price levels declining secularly.

Analysts often associate the “Japan syndrome” to the country’s exports-led growth model and demographic changes. Dependence on exports made Japan vulnerable to the shocks suffered by the world market, because the savings accumulated through exports were the source of its real estate bubbles.

In terms of demographics, Japan’s labor supply reached its peak in 1993, after which it started sliding toward an aging society; in fact, it now has the highest proportion of aged people. One of the dire consequences of Japan’s aging society is the continuous decline in its domestic demand.

China, too, followed an exports-led growth model for faster economic development. Like the 1973 oil crisis, the 2008 global financial crisis dealt a major blow to the world economy. As a result, China’s export-oriented growth has decelerated since. And like in Japan in the late 1980s, the exports-led high rate of savings have contributed to China’s real estate and stock market bubbles.

Moreover, China’s demographic change is ahead of Japan by 20 years in terms of the two countries’ per capita GDP. China’s per capita GDP today is equivalent to that of Japan in the early 1970s, but China’s labor supply has already begun to decline. In 10 to 15 years, China’s baby-boom generation, those born between 1963 and 1976, will exit the labor market. Thus the Chinese economy could suffer the same fate as that of Japan.

However, China has one advantage, though, that is, it has a population 10 times that of Japan and an even larger territory. For one thing, the per capita GDP of China’s nine coastal provinces/cities is twice as much as that of the inland provinces. As such, the force of convergence will ensure the inland provinces continue to grow even after the coastal region stops growing.

Eastern European countries provide a good example of the force of convergence. In the 1990s, these countries were devastated by the shock therapy they adopted during their transition from command economies to market economies. The turning point came when they joined the European Union and adopted the euro, which turned their backwardness into a great advantage. Now, many of them have joined the ranks of high-income countries.

China as an economy represents the whole of Europe. The global financial crisis has given China’s inland provinces a chance to catch up with their coastal counterparts. Thanks to the Chinese authorities’ efforts to balance the distribution of industries across the country, several inland cities have become industrial centers; they are ready to accept the industries moving from the coast to the inland. Samsung’s big investment in Xi’an, Shaanxi province, is but one example.

It is thus highly possible that China will do better than Japan did between 1973 and 1993. But for the inland provinces to close the income gap with the coastal region in 20 years, they will have to grow 3.5 percent faster. And even if China’s coastal region registers a 3.4 percent growth, the same as Japan between 1973 and 1993, the whole country would grow by 5.4 percent.

Although it would be much lower than what China achieved before 2010, the growth rate would allow the country to become a much richer society in 20 years and China’s per capita real income could reach $28,600 (measured in today’s PPP).

Therefore, China is likely to replace the United States as the world’s largest consumer market, which by all means would be good news for the rest of the world.

The author is a professor at and director of China Center for Economic Research and National School of Development, Peking University.

I’ve lived in China for quite a considerable time including my graduate school years, travelled and worked in a few cities and still choose my destination taking into consideration the density of smog or PM2.5 particulate matter in the region.