Tianjin Updates

2025-09-17

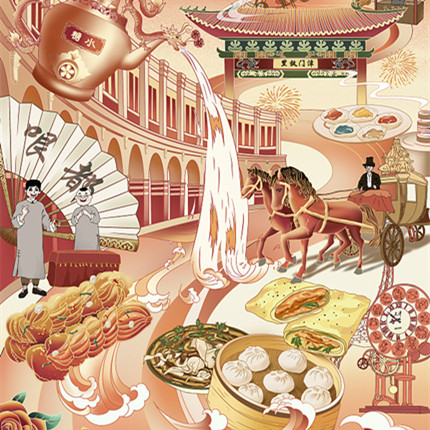

Industrial cooperation within SCO

Against the backdrop of a tariff war and instability in the global economy, industrial cooperation among Shanghai Cooperation Organization countries is gaining particular importance. By combining human potential and natural resources, the SCO member states are able to form sustainable production chains and develop complementary industries.

read more- Robots entering Chinese homes

- China home to over 5,000 AI companies

- China reiterates SCO role as 'dynamic platform for tangible cooperation'

Copyright ©? Tianjin Municipal Government.

All rights reserved. Presented by China Daily.

京ICP備13028878號(hào)-35

Why Tianjin

Why Tianjin Investment Guide

Investment Guide Industry

Industry Industrial Parks

Industrial Parks

Health

Health Visas

Visas Education

Education Sports and recreation

Sports and recreation Adoption

Adoption Marriage

Marriage