Tax for olive-shaped society

|

|

The Bund and its many buildings are one of Shanghai's most photographed sites, Oct 4, 2013. [Photo/IC] |

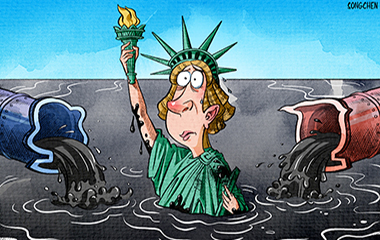

The State Council, China's Cabinet, is planning to further lighten the tax burden on low- and middle-income people and moderately increase the tax on those with high incomes as a way to better regulate the country's income distribution.

Raising the incomes of poorer people and controlling excessive increases in the incomes of wealthy people would be a positive step toward expanding the middle-income group and promoting reasonable distribution of social wealth.

However, the problem is what constitutes a high income.

According to China's extant law, people who make more than 120,000 yuan ($17,725) or more a year have a high income and have to report to the taxation authorities their incomes for tax purposes at the end of every year. So, the document issued by the State Council announcing its reform plan has sparked concerns about whether the country will increase tax on people with an income above this level.

Compared with the 2015 data released by the National Bureau of Statistics, which indicates the per capita wage of employees in surveyed units was 53,615 yuan, the 120,000-yuan annual income is not low. But for many white-collar workers, such an annual income merely makes their ends meet in big cities.

Against the backdrop of China's steady economic growth, employees' incomes are expected to further increase. Thus more people in big cities may see their annual income approach or exceed the 120,000 yuan threshold in a few years. But that does not mean all these people will have high incomes by that time.

Undoubtedly, a low threshold for defining a high income will extensively affect the middle-income group. The country should use a higher standard so that it has room to accommodate people's incomes in the future. The efforts to build an olive-shaped society mean the country needs to extend more tax tolerance to the middle class.

--Beijing News

- Tianjin solves housing problems for low-income families

- Seventy percent of people in Shanghai middle-income earners

- Changsha county's tourism income doubles during Golden Week 2016

- Improving Income and Ensuring Stable Employment to Raise the Degree of Satisfaction with Life for Urban and Rural Residents —Analysis Based on 12714 Household Questionnaires from 8 Provinces in 2015(No.113, 2016)

- Allowance for low-income earners should be simple

- Shrinking income gap between grads and migrants not a surprise

- High-income, no weekends: Post-90s property beauty's daily life

- Social security crucial to balanced income distribution