Structural reform to beat middle-income trap

|

|

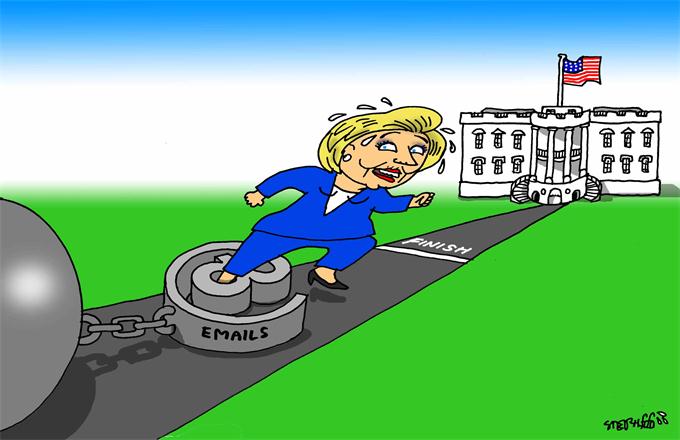

Workers assemble lithium batteries in Huzhou, Zhejiang province. The electric-car industry gives a boost to the battery manufacturing sector. [Photo/China Daily] |

Today China is seen as an "upper-middle-income" country. But only structural reforms will allow it to avoid the middle-income trap.

A recent report by the Chinese Academy of Social Sciences says China has entered the ranks of the "upper-middle-income" countries. While most observers agree the pace of transformation has been extraordinary in China, many remain concerned about increasing wealth and income inequality. Others point to successful industrialization in East Asia-from Japan to the Republic of Korea-arguing that improving social welfare will be critical to avoiding the middle-income trap.

These viewpoints are not mutually exclusive. Together, they drive the rebalancing of the Chinese economy, and the associated new urbanization and industrial upgrading that seeks to overcome the middle-income trap in the next 10 to 15 years. But why do many countries get stuck in the trap?

China has been a so-called upper-middle-income country for a few years. The CASS report relies on the World Bank classification, which groups economies based on gross national income (GNI) per capita. Based on the World Bank's method, it groups countries to four categories: low-income economies ($1,025 or less); lower middle-income economies ($1,026-$4,035); upper middle-income economies ($4,036-$12,475); and high-income economies ($12,476 or more).

In the early days of economic reform, China was in the low-income group. In 2008, after decades of investment and export-led growth, China joined the ranks of the lower-middle-income countries.

According to the CASS, China's per capita GDP is currently $8,016 (52,000 yuan). In effect, China joined the ranks of the upper middle-income countries around 2012. As a result, living standards in China are approaching those in Turkey, Brazil and Southern Europe. But these findings should be taken with a grain of salt.

Today's advanced economies industrialized in the late 19th and early 20th centuries. So they have enjoyed the benefits of wealth and income for a long time. In China and other emerging economies, prosperity is still new-and thus far, far more fragile.

Just because an economy has great potential does not always mean that this promise will be delivered. And yet that's what Goldman Sachs' Jim O'Neill, who created the "BRIC" concept in the early 2000s, seemed to imply. While O'Neill did wonderful work in promoting emerging economies, analysts focus on abstract data rather than real life.

If the theory had been valid, we would continue to see solid economic progress in China, India, Brazil and Russia.

But the reality is that we don't. The emerging and developing economies have always relied on diverse sources of industrial advantages. Before the global crisis, those BRIC economies that relied excessively on their natural resources enjoyed high growth as long as the prices of oil, gas and commodities continued to soar. Conversely, with the end of the "commodities super-cycle", the very same economies have taken heavy hits.

What's worrisome, even though economies diversify their industrial structures and get their policies right, external constraints-including sanctions by Western nations-effectively undermine the benefits of modernization.

It is for these reasons that I have argued, for more than a decade, that the hopes associated with some BRIC economies will prove inflated. It was misguiding in the early 2000s to project glorious futures for economies that relied excessively on resource-and commodity-driven growth.

What really matters in economic development is not only industrialization but how it actually materializes.

Once, when I met the legendary investor Jim Rogers and we talked about the future of emerging economies, he referred to some BRIC analysts as "number crunchers." It sounded pejorative but, while Rogers is a commodity expert, he started his career as a historian and knows too well that numbers without history and context are hollow.

In this regard, China is better positioned to overcome the middle-income trap with a more diversified industrial structure, as long as regional rebalancing can proceed and the external environment remains peaceful.

However, it does not follow that all, or even most emerging economies can follow in the footprints. Success requires structural reforms.

The author is a guest fellow at Shanghai Institutes for International Studies (SIIS), and founder of Difference Group. This commentary is based on his SIIS project on "China and the multipolar world economy".