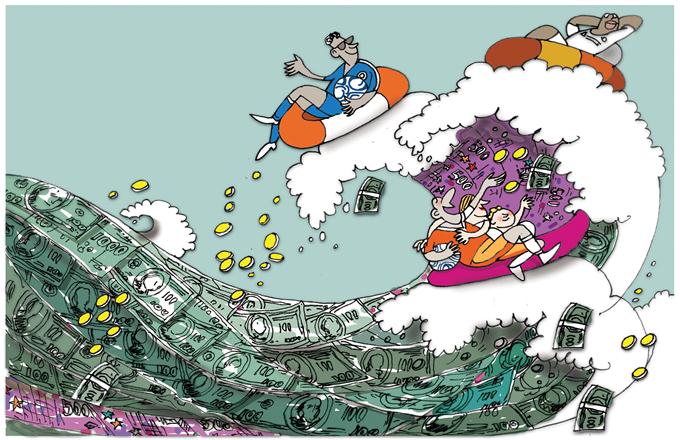

Trumping the yuan in a volatile world

|

|

A $100 banknote is placed next to 100 yuan banknotes in this October 16, 2010 file picture illustration taken in Beijing. [Photo/Agencies] |

At the recently concluded World Economic Forum Annual Meeting in Davos, Switzerland, President Xi Jinping mounted a robust defense of globalization, reaffirming his country's "open-door" policy and pledging never to seek to start a trade war or to benefit from depreciation of its currency. Soon after, US President Donald Trump, in his inaugural address, effectively made the opposite pledge: using the word "protect" seven times, he confirmed that his "America First" doctrine means protectionism.

Trump speaks of the United States as an economy in decline that must be revitalized. But the reality is that the US economy has been performing rather well over the last two years.

The dollar's value has risen particularly high in the last few months, as Trump's promises to increase government spending, lower business taxes, and cut regulation have inspired a flight to quality by investors. In contrast, the Chinese yuan has weakened significantly-from 6.2 yuan per dollar at the end of 2014 to 6.95 yuan at the end of last year-owing largely to declining investment and exports.

Trump has accused China of intentionally depreciating the yuan, in order to boost its export competitiveness. But the truth is the opposite: in the face of strong downward pressure on its currency, China has sought to keep the yuan-dollar exchange rate relatively stable-an effort that has contributed to a decline of more than $1 trillion in its official foreign exchange reserves.

China does not want the yuan to depreciate any more than Trump does. But no country has full control over its exchange rate.

China is already shifting from an export-driven growth model to one based on higher domestic consumption, so a stronger yuan might serve its economy better. China's current-account surplus fell to just 2.1 percent of GDP in 2016, and the International Monetary Fund projects it to narrow further, as exports continue to fall.

Even on the financial account front, a depreciating yuan doesn't serve China.

According to the IMF, by 2021, the US net investment position will probably deteriorate-with net liabilities rising from 41 percent of GDP to 63 percent-while China's net investment position may remain flat. This means other surplus countries such as Germany and Japan are likely to be financing the growing US deficit position, from both their current and financial accounts. (The expanding interest-rate differentials between the US and its advanced-country counterparts reinforce this expectation.)

But perhaps the biggest challenge for China today lies in its capital account. Since the yuan began its downward slide in 2015, the incentive to reduce foreign debts and increase overseas assets has intensified.

China's total foreign debts (public and private), already very low by international standards, fell from 9.4 percent of GDP ($975.2 billion) at the end of 2014 to 6.4 percent of GDP ($701.0 billion) by the end of last year. This trend seems set to continue, as Chinese citizens continue to diversify their asset portfolios to suit their increasingly international lifestyles. A weaker yuan will only bolster this trend.

Of course, Trump, who has repeatedly threatened to impose tariffs on China, could also influence China's exchange-rate policy. But, in a sense, Trump's irreverence makes him practically irrelevant. Judging by his past behavior, it seems likely that he will accuse China of currency manipulation, regardless of the policy path it chooses: a completely free float with full convertibility, the current managed float, or a pegged exchange rate.

So what is China's best option? A free-floating exchange rate can be ruled out, because in the current dollar-driven global monetary regime, such an approach would produce too much volatility.

But even the current regime is becoming difficult to manage. Considering the cost of recent efforts to maintain some semblance of exchange-rate stability, it seems that not even the equivalent of $3 trillion in foreign exchange reserves is enough to manage a currency float.

China can, and should, broaden and deepen its international investment position, in order to support currency stability. At the end of 2015, China's gross foreign assets were relatively low, at 57.2 percent of GDP, compared to about 180 percent for Japan and many European countries and around 130 percent for the US. China's net foreign assets amounted to only 14.7 percent of GDP, compared to 67.5 percent for Japan and 48.3 percent for Germany (negative 41 percent of GDP for the US). Reforms in the real and financial sectors would enable this level to rise.

For now, however, the best option for China may be to peg the yuan to the dollar, with an adjustment band of 5 percent, within which the central bank would intervene only lightly, to guide the market back to parity over the long term. Investors are, after all, focused almost exclusively on the yuan-dollar exchange rate.

Andrew Sheng is distinguished fellow of the Asia Global Institute at the University of Hong Kong and a member of the UNEP Advisory Council on Sustainable Finance. Xiao Geng, president of the Hong Kong Institution for International Finance, is a professor at the University of Hong Kong.