Keeping property market cool remains key

|

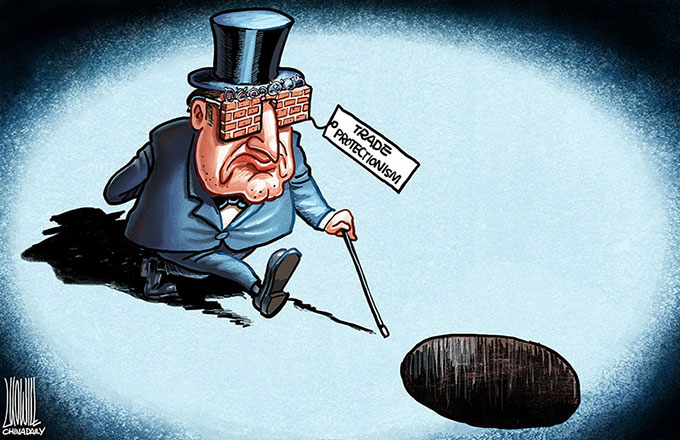

| LUO JIE/CHINA DAILY |

China's property market showed restraint after growing strongly last year. Accelerating home sales and rising property prices triggered fears of an asset bubble forming. As a result, cooling measures were implemented in October, characterized by city-specific rules targeted mostly at tier-1 and overheated tier-2 cities.

To assess the property market's developments in the second half of last year and gauge developers' outlook for the first half of this year, we (at Standard Chartered China) conducted a semi-annual survey of the property markets in first-, second- and third-tier cities in February after the Spring Festival holiday.

The survey shows developers' construction activity accelerated in the second half of last year, and the momentum is expected to continue in the first half of this year. The momentum in second- and third-tier cities was stronger than in first-tier cities due to expectations of better sales and the need to accelerate sales revenue. Some developers in third-tier cities reported favourable measures from their local governments supporting construction.

The appetite of developers to purchase land remained strong, while land supply appeared to have remained relatively tight. Land parcels in top-tier cities and cities without home purchase restrictions were most popular. While developers in tier-1 and tier-2 cities were keen to increase land reserves for strategic development and further expansion, developers in tier-3 cities faced higher local land prices due to developers from other cities entering their markets. Given the demand-supply dynamics, a majority of developers expected mild increases in land prices in the first half of 2017, with some in tier-2 and tier-3 cities expecting an increase of more than 20 percent.

The developers in tier-1 cities expected housing sales to lose steam, whereas because of the increase in sales in tier-2 and tier-3 cities in the second half of 2016, developers there expected higher sales in the first half of this year.

The survey revealed that primary market prices rose across all cities in the second half of 2016, with the most noticeable price gains seen in tier- 2 cities. In terms of the price outlook for the first half of this year, most developers expect a mild increase in prices of new projects.

However, developers' financing conditions seem to be improving after a period of resilient sales and accommodative monetary policy. The developers said funding costs of both bank and non-bank financing eased slightly in the second half of last year, but funding access did not improve in concrete terms.

Mortgage policies have tightened in tier-1 and tier-2 cities. The survey showed that average mortgage rates in second- and third-tier cities had discounts of up to 15 percent and up to 20 percent for first-home buyers, whereas developers said only a 5 percent discount available in first-tier cities. Second-home buyers had almost no discount on mortgage rates, and some top-tier cities even saw mortgage rates rise by 10 percentage points.

The surveyed developers expect the central government policy to tighten further. They also expect some restrictive measures from local governments. And developers in tier-1 cities expect the most restrictive policies, including higher down-payments, further tightening of mortgage lending, and stricter residency policy and purchase restrictions. While only one-third of the developers in tier-2 cities expect local governments to further tighten the policy, those in tier-3 cities expect further tightening measures from their local governments mainly in terms of developer financing.

Maintaining a reasonable growth of housing prices is one of the most important targets for China's policymakers. We do not see a potential sharp decline in housing prices; instead, we see a rather stagnate price gain with stable housing investment this year.

The government has pledged to discourage speculation in the property market and establish a long-term mechanism to contain property bubbles. Possible measures include a mortgage policy supporting real demand and an increase in land supply in top-tier cities where demand is strong and rigid. We believe the introduction of a well-designed and revenue-neutral property tax needs to be an integral part of any long-term solution.

Besides, maintaining a healthy and stable property market is still strategically important to policymakers given the sector's importance to the economy. But containing asset bubbles and related financial market risks will remain a key task for policymakers this year.

The author is an economist at Standard Chartered China.

- Property tax bill not to be discussed this year: Spokesperson

- Streamlining the rental property market

- China seeks stable development in property market

- China to step up property tax legislation: official

- China capable of ensuring stability in property market: Official

- Shanghai becomes most attractive property market in Asia

- Chinese investors pile into London property market

- Tighter property loans squeeze homebuyers