Curbing commercial property sales for residential use good move

|

|

Potential home buyers check out a property project in Beijing. [Photo/VCG] |

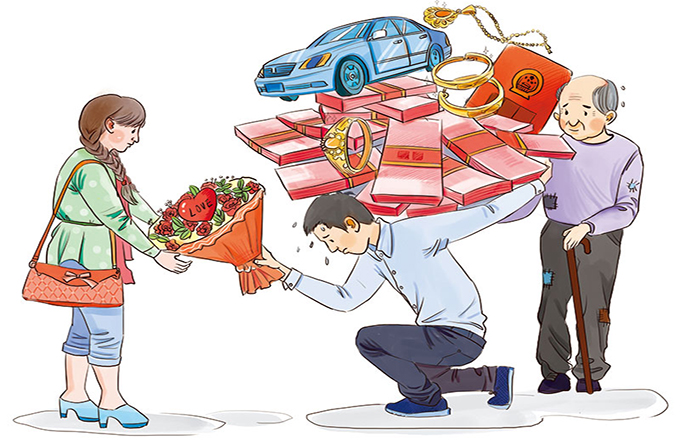

On Sunday, the Beijing municipal government further regulated the market for commercial properties, prohibiting developers from selling such properties under construction to individuals. Banks have also been instructed to suspend the issuing of loans to individuals who have signed contracts to buy already constructed buildings for business use. Beijing Youth Daily comments:

In Beijing, only those with a local residence registration, or people who have paid individual income tax for 60 successive months, are allowed to buy residential houses. In order to circumvent the legal limit, some developers construct buildings for business use, but actually sell them to individuals for residential use.

Such deeds are undoubtedly illegal. And commercial properties are inconvenient to those who buy them for residential use because their utility services are more expensive than normal. Worse, the properties are designed for business use, and the developers must change the designs in order for them to be suitable for residential use, which can involve safety risks.

By doing so, the developers have helped those not eligible for purchasing property to get into the housing market, which compromises the municipal government's efforts to control the market. so far this year, the number of deals involving commercial properties for residential use has exceeded the number of residential house purchases, intensifying speculation.

Quite a number of hot money investors have been attracted to buy commercial properties for residential use. Their speculation has squeezed the normal needs of businesspersons by pushing the prices of commercial properties higher. Official data show that over the past year, the average price of commercial buildings in Beijing has risen by almost 100 percent.

Therefore, the move by the Beijing municipal government is timely. By suspending loans and no longer allowing individuals to buy commercial properties for residential use, it will cool the capital's realty market.