Deutsche Bank admits to 'mistakes'

Updated: 2007-09-21 07:01

Deutsche Bank AG, Germany's biggest bank, will write down the value of leveraged loans and scale back hiring plans after making "mistakes" during the credit boom that ground to a halt in the past two months, Chief Executive Officer Josef Ackermann said.

"We have certainly also made exaggerated commitments in the whole euphoria," Ackermann said in an interview in Berlin with Germany's ZDF television. He said the bank probably won't proceed with plans to hire about 6 percent more people though he doesn't expect to cut jobs.

Deutsche Bank may be the hardest hit of European securities firms from the fallout of rising US subprime mortgage defaults. The Frankfurt-based bank, which said on September 4 it has leveraged-loan commitments of 29 billion euros, may have to take a 625 million-euro charge in the third quarter, according to analysts at JPMorgan Chase & Co.

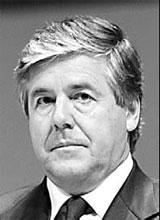

"We are now correcting values of all these loan commitments for the next nine months," Ackermann (above right) said. "This is very conservative but right."

Deutsche Bank shares have fallen 7.1 percent this year to 94.17 euros on concern that a slowdown in fixed-income markets will hurt earnings. The bank gets about half of its profit from debt markets, JPMorgan analysts estimate. The 65-member Bloomberg Europe Banks and Financial Services Index has fallen 8.8 percent.

New York-based Morgan Stanley, the world's second-biggest securities firm, missed analysts' estimates yesterday because of losses on loans for leveraged buyouts and a decline in fixed- income trading revenue. Third-quarter profit from continuing operations dropped 7 percent to $1.47 billion. Lehman Brothers Holdings Inc's earnings on Wednesday included a $700 million loss after writing down mortgage holdings and loan commitments.

Ackermann said earlier this month that "turbulent" conditions in August reduced trading revenue, though he extolled the performance of "stable" businesses of consumer banking and money management.

He told investors last week that the bank is "confident of delivering" on its profit targets for next year and beyond as analysts are cutting their estimates. The median estimate for 2008 pretax profit of 10 analysts that updated their forecasts this month is about 4 percent below the bank's 8.4 billion-euro target, according to data compiled by Bloomberg.

Ackermann didn't talk about profit targets in the ZDF interview. He said he would take a pay cut if the bank didn't meet its goals.

Job cuts

"If we earn half, then I should get half too, or even less," Ackermann said. He earned 13.2 million euros in 2006, 11 percent more than a year earlier.

The bank had been planning to expand its headcount to about 80,000 this year from 75,140 at the end of June, Ackermann said. "We probably won't do that now," he said.

Wall Street rivals, including Merrill Lynch & Co and Bear Stearns Cos have announced plans to cut jobs, particularly in the subprime mortgage operations.

Financial markets are going through a "painful" correction, Ackermann said, adding that he's "confident" they will stabilize.

Central banks pumped cash into the world's money markets since August 9 to smooth lending between commercial banks. The Federal Reserve lowered its benchmark lending rate by half a percentage point on Tuesday in an effort to prevent an economic slump in the US as a result of the turmoil in credit markets.

Time bomb

"There is no bigger time bomb ticking," he said. A recession is unlikely, although US economic growth will probably slow down by between 0.5 and 1 percentage points, he said.

The decision to cut rates was "right" because it gives "a psychological boost", Ackermann said. "One shouldn't interpret this as an act of desperation."

He also said that he doesn't expect a run on deposits in Germany similar to Northern Rock Plc, the UK mortgage lender bailed out by the Bank of England last week.

"German banks are well capitalized," he said. "We finance much more through customers' deposits and we have deposit guarantee instruments that go much further than in England."

Bloomberg News

(China Daily 09/21/2007 page16)

|

|

|

||

|

||

|

|

|

|