Tax rebate deal could mean checks by May

Updated: 2008-01-25 10:39

WASHINGTON -- With unprecedented speed and cooperation, Congress and the White House forged a deal Thursday to begin rushing tax rebates of $600 to $1,200 to most tax filers by spring, hoping they will spend the money just as quickly and jolt the ailing economy to life.

|

|

Rebates would be even higher for families with children.

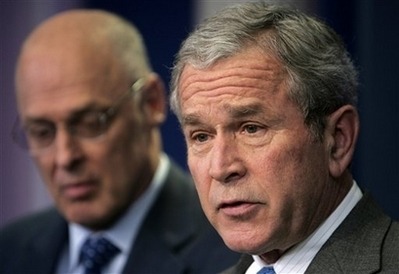

The one-time tax rebates are at the center of a hard-won agreement to pump about $150 billion into the economy this year and perhaps stave off the first recession since 2001. House Speaker Nancy Pelosi, Republican leader John Boehner and Treasury Secretary Henry Paulson worked out the details in negotiations that stretched into Wednesday night at the Capitol.

About two-thirds of the tax relief would go out in rebate checks to 117 million families beginning in May. Businesses would get $50 billion in incentives to invest in new plants and equipment.

Individual taxpayers would get up to $600 in rebates, working couples $1,200 and those with children an additional $300 per child under the agreement. In a key concession to Democrats, 35 million families who make at least $3,000 but don't pay taxes would get $300 rebates.

The rebates would phase out gradually for individuals whose adjusted gross income exceeds $75,000 and for couples with incomes above $150,000. Contributions to IRA and 401(k) retirement accounts and health savings accounts would not count toward the income limit.

"This package will lead to higher consumer spending and increased business investment," Bush said in hailing the agreement.

The bill will go straight to the House floor next week and on to the Senate, where some Democrats hope to add elements such as extending unemployment benefits for workers whose benefits have run out.

Indeed, many Democrats, such as Ways and Means Committee Chairman Charles Rangel, D-N.Y., and Edward Kennedy of Massachusetts, the liberal lion of the Senate, were deeply unhappy that Pelosi agreed to jettison that proposal in late-stage talks, as well as plans to increase food stamp payments.

"I do not understand, and cannot accept, the resistance of President Bush and Republican leaders to including an extension of unemployment benefits for those who are without work through no fault of their own," Rangel said.

The administration signaled it's unlikely to welcome efforts to broaden the measure, and pressure was mounting in the Senate to accept the hard-won deal.

"The American people are not going to have a lot of patience for taking time," Paulson said.

If the Senate gives quick approval, the first rebate payments could begin going out in May and most people could have them by July, he said.

It has become increasingly clear that the economy is teetering on the edge of recession, if it hasn't already gone over that line. The crisis in subprime home loans has hit hard at many lending institutions, cramping credit for almost everyone else. Economic growth has all but disappeared, companies are reporting big losses and Wall Street had been tumbling day after day -- even after emergency Federal Reserve rate-cutting -- until Wednesday's hopeful talk about the stimulus deal. The Dow Jones industrial average was up more than 100 points Thursday after soaring nearly 300 the day before.

In addition to concerns openly expressed by lawmakers, members of Congress are not eager to run for re-election this fall with voters fearful of losing jobs in a recession.

For businesses, the stimulus measure would allow them to immediate tax write-offs for 50 percent of the purchase price of plants and other capital equipment and permit small businesses to write off additional purchases of equipment. A provision to allow businesses suffering losses now to reclaim taxes previously paid was dropped in end-stage talks.

Pelosi, D-Calif., agreed to drop increases in food stamp and unemployment benefits in exchange for gaining the rebates of at least $300 for almost everyone earning a paycheck, including those who make too little to pay income taxes.

"I can't say that I'm totally pleased with the package, but I do know that it will help stimulate the economy. But if it does not, then there will be more to come," Pelosi said. She said that House Democrats may act on other proposals to stimulate the economy, particularly if it worsens in coming weeks.

Boehner said the agreement "was not easy for the two of us and our respective caucuses."

"You know, many Americans believe that Washington is broken," the Ohio Republican said. "But I think this agreement and I hope that this agreement will show the American people that we can fix it."

Paulson said he would work with the House and Senate to enact the package and declared that "speed is of the essence." He cautioned that "the work is far from over."

The agreement left some lawmakers in both parties with a bitter taste, and they complained that their leaders had sacrificed too much in the interest of striking a deal. Many senior Democrats were particularly upset that the package omitted the unemployment extension.

Majority Leader Harry Reid, D-Nev., said the goal is to send the package to the White House by Feb. 15 for Bush's signature, but he noted the Senate was likely to try to add more spending.

Bush had supported larger rebates of $800-$1,600, but his plan would have left out 30 million working households of people who earn paychecks but don't make enough to pay income tax, according to calculations by the Urban Institute-Brookings Institution Tax Policy Center. An additional 19 million households would receive only partial rebates under Bush's initial proposal.

To address the mortgage crisis, the package raises the limit on Federal Housing Administration loans from $362,790 to as high as $729,750 in expensive areas, allowing more subprime mortgage holders to refinance into federally insured loans. To widen the availability of mortgages across the country, it also provides a one-year boost to the cap on loans that Fannie Mae and Freddie Mac can buy, from $417,000 up to $729,750 in high-cost markets.

|

|

|

||

|

||

|

|

|

|