Subprime crisis may cost $945B worldwide: IMF

(Agencies)

Updated: 2008-04-09 15:38

Updated: 2008-04-09 15:38

|

|

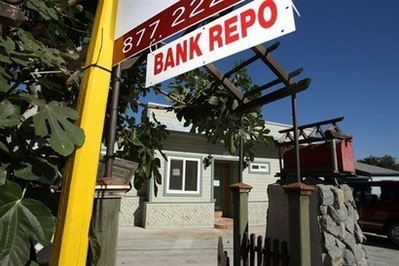

WASHINGTON - The International Monetary Fund said Tuesday the worldwide losses stemming from the US subprime mortgage crisis could hit 945 billion dollars as the impact spreads in the global economy.

The IMF, in a particularly stark report, said that falling US housing prices and rising delinquencies on the residential mortgage market could lead to losses of 565 billion dollars.

Combined with other categories of loans originated and securities issued in the United States related to commercial real estate, the consumer credit market, and corporations "increases aggregate potential losses to about 945 billion dollars," it said.

"The crisis is spreading beyond the US subprime market -- namely to the prime residential and commercial real estate markets, consumer credit, and the low- to high grade corporate credit markets," the IMF said in releasing its semiannual Global Financial Stability Report.

While the US remains the epicenter, "financial institutions in other countries have also been affected, reflecting the same overly benign global financial conditions and to varying degrees -- weaknesses in risk management systems and prudential supervision."

It was the first time the multilateral institution has made an official estimate of the global losses suffered by banks and other financial institutions in the credit squeeze that began eight months ago in the US, amid rising defaults on subprime, or high-risk, home loans.

The staggering 945 billion dollar estimate of losses, made in March, represents roughly 142 dollars per person worldwide and represents four percent of the 23.21-trillion-dollar credit market.

The IMF said that global banks likely will shoulder about half of the losses -- at 440 billion dollars to 510 billion.

Last month, Standard & Poor's estimated global banking firms would likely write off 285 billion dollars in various securities linked to US subprime real estate, with more than half the losses already recognized. Some analysts have put the figure higher for the subprime market and related losses.

"Leading indicators point to a tightening of credit conditions across many economic activities," Jaime Caruana, head of the IMF's Monetary and Capital Markets Department, said at a news conference.

Caruana said the losses "suggest a potentially large impact on US economic growth," and that Europe may also see tightening conditions and slowing credit growth under the global financial strain.

The IMF releases its biannual World Economic Outlook on Wednesday and already has said it would slash a half percentage point off its forecast of 2008 global economic growth, to 3.7 percent.

The Global Financial Stability Report cautioned that loss estimates were imperfect and could go higher.

The unusually precise and harsh report comes ahead of the IMF and the World Bank spring meetings Saturday and Sunday in Washington.

The IMF, whose core mission is to promote global financial stability, said there was "a collective failure to appreciate the extent of leverage taken on by a wide range of institutions -- banks, monoline insurers, government-sponsored entities, hedge funds -- and the associated risks of a disorderly unwinding."

"It is now clear that the current turmoil is more than simply a liquidity event, reflecting deep-seated balance sheet fragilities and weak capital bases, which means its effects are likely to be broader, deeper, and more protracted," it said.

The report criticizes the "excessive risk-taking" and "weak underwriting" undertaken by under-capitalized institutions and recommends measures including ratings systems reform and a change in compensation schemes for managers of financial institutions.

|

||

|

||

|

|

|

|