|

|

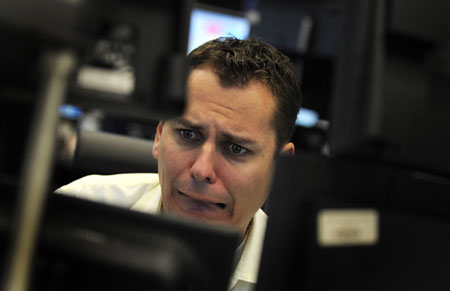

Share trader Tom Holler reacts on the opening course as he sits behind his trading terminal at the Frankfurt stock exchange, October 10, 2008. [Agencies]

|

An overnight carnage on Wall Street sparked another round of massive stock sell-off in Asia and Europe, sending key indices in Japan, Britain and Germany down as much as 10 percent.

Asian and European investors awoke to news that the Dow Jones Industrial Average in the United States dived 679 points Thursday to extend its losses so far this week to an awesome 17 percent.

The steep losses spooked equity holders, who in a knee-jerk reaction, jumped on a selling-spree at the opening bell. Within minutes of trading, Japan's benchmark Nikkei 225 stock average fell more than 10 percent, Korean stocks dropped 9 percent and the Hang Seng Index of Hong Kong declined more than 7 percent.

Several hours later in Europe, the FTSE 100 Index of England and Germany's DAX index fell as much as 10.2 percent shortly after trading started, while France's CAC 40 index witnessed the biggest fall since 1987, diving 9 percent.

The Shanghai market fared better, but sell-off pressure was heavy. The benchmark Shanghai Composite Index opened 3.8 percent lower at 1,995.96 points, breaching the psychologically important level of 2,000 points, which was significant to both regulators and investors. Two days after the mark was broken through last time, the State Council cut stock trading tax and promise share buybacks, sparking a huge rally.

The Shanghai gauge ended the day marginally above 2,000 points at 2,000.57, a loss of 3.57 percent over the previous close. The Nikkei 225 closed 9.62 percent lower, after plunging as much as 11 percent as a point. Hong Kong's HSI index was down 7.95 percent when the closing bell sounded.

Chinese investors seemed to get little comfort from another effort by the China Securities Regulatory Commission (CSRC) to prop up confidence.

The CSRC announced Thursday that listed firms must pay dividends in cash totaling no less than 30 percent of its distributed profits over the previous three years before submitting their refinancing applications.

The new measure could help encourage long-term investment and reduce market volatility, the CSRC said. Lack of cash dividends was blamed as one of the key culprits for high volatility in China's stock markets, where five-percent or more daily ups and downs are commonplace, as investors can only bank on share prices gains.

While beneficial to the long-term good of the stock market, the measure failed to address the immediate concerns of the crisis-preoccupied investors.

Investors feared the escalating financial crisis may prolong the economic difficulties of the US and Europe, two key export destinations for both China and other Asian economies.