China's sustainable investing shows no sign of letting up

China's nascent trend in ESG-environmental, social and governance-investing appears to be alive and well despite the disruption caused by the COVID-19 pandemic.

China's recovery from the economic blow of the COVID-19 crisis presents a potential watershed moment for sustainable investing in the country.

Across the range of ESG elements, Chinese policymakers are today faced with a historic opportunity in moving the country toward a more sustainable growth model.

As is the case in many countries around the world, the depth and the speed of the economic contraction brought on by the pandemic-related lockdown has meant that kick-starting growth and preserving jobs have been the main concerns of Chinese policymakers in recent months, with more stimulus flowing into areas like infrastructure investment.

But this should not necessarily result in a resurgence of smokestack industries if environmental standards are upheld as promised by the government. At the end of May, Huang Runqiu, minister of ecology and environment, said that environmental regulation would not be relaxed despite economic challenges.

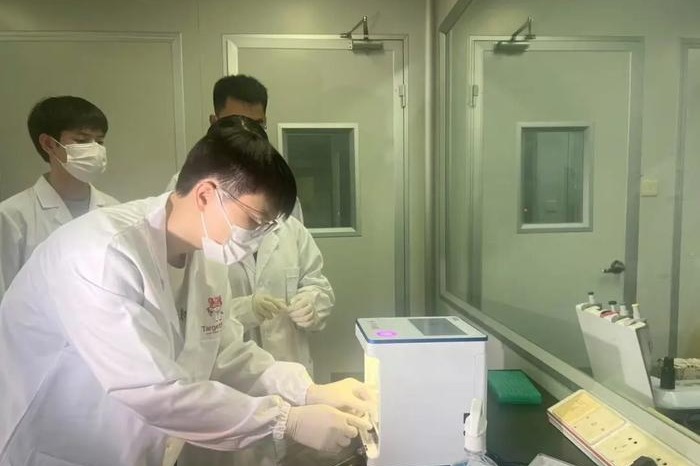

In fact, as we consider the overall mix within the country, we are seeing brighter prospects for new economy areas like e-commerce and biotech. We think the fallout and dislocation in the wake of the outbreak is creating room for a green recovery while also spurring new awareness about corporate social responsibility.

In short, China's embrace of ESG shows no sign of letting up. Below, we look at three key areas where we see sustainable investing on the rise in China.

A cleaner shade of green

Chinese green bond proceeds more than tripled from March to $2.6 billion in April, accounting for about 16 percent of global total, according to Climate Bonds Initiative data.

For global investors eyeing China's ESG opportunities, the gap between Chinese and European green bond standards remains a key concern. For example, China has set no carbon emission thresholds for issuers, whereas European regulators have specified emission limits.

Progress is being made toward harmonizing the standards. In May, China's central bank proposed to remove so-called clean coal, which involves a purifying process to boost fuel efficiency, from its green bond definition. In Europe, fossil fuel activities are generally excluded under green finance rules proposed in 2018 and enacted this year.

For Chinese policymakers, removing loopholes for clean coal represents a bold move given the country's heavy reliance on coal-fired electricity production, which accounts for more than half of nationwide energy use, compared to about one-tenth today in the United States.

As it further opens financial markets to foreign investors, China could do more to capture a rise in global demand for green bonds. Greater harmonization of standards should help to fund not only domestic growth, but also many of the overseas projects that China is keen to promote, including those under the Belt and Road Initiative.

Meanwhile, boosting infrastructure investment is one of China's key responses to the pandemic. While traditional concrete pouring is expected to feature prominently in the building boom, the authorities are encouraging greener projects like recycling, waste and water treatment and energy-saving facilities. Directing more funds toward green infrastructure could bring long-lasting benefits beyond stimulating the current economy.

The idea of boosting consumer spending in a greener way has also found its way into government stimulus experiments in the wake of the outbreak. Discount coupons for buying electric vehicles were handed out to residents in the southeast city of Ningde in May, while officials of the northwest city of Xining distributed so-called "green coupons "starting from June, which could be used at merchants deemed environmentally friendly by the government.

Highlighting the'S' in ESG

For Chinese companies, the pandemic has offered the biggest test of collective social responsibility in years, with a slump in exports and city lockdowns threatening millions of jobs and livelihoods.

In February and March, many large State-owned enterprises stepped up to pledge not to cut jobs during the outbreak, which has helped stabilize the Chinese economy in the face of an unprecedented challenge. The Heilongjiang government, for instance, urged SOEs in the northeast province to keep all their workers in March.

And it wasn't just the SOEs-private-sector companies like Midea and Galanz, for instance, have also vowed not to cut jobs or wages during the outbreak.

Some State-owned giants went beyond vowing to preserve jobs, and took action to help bail out their smaller private suppliers during the COVID-19 crisis.

China Mengniu Dairy, for instance, provided zero-interest funding to cow farms caught up in temporary financial liquidity problems. The dairy producer also prevented a lot of raw milk from going to waste by maintaining its purchases-despite a falloff in consumer demand-and converting it into powder.

Although this may squeeze Mengniu's near-term margins, it should help preserve its supply chain and boost its sustainability over the long run.

Similarly, ride-hailing private company Didi Chuxing worked with leasing firms to provide financial relief for drivers in February, extending vehicle leases and postponing leasing charges for a month, which amount to 3,000 yuan to 4,000 yuan ($420-$560) for an average driver. Drivers also received free masks and disinfection services during the outbreak.

Governance is improving

On the regulatory and disclosure front, China's push for better corporate governance appears uninterrupted by the epidemic.

The revised Securities Law came into effect in March, featuring a landmark section that supports class actions by shareholders for the first time in China.

Collective legal actions had been rare among Chinese shareholders for a lack of recourse as well as awareness. In a 2017 lawsuit against a listed company named P2P Financial Information, only 14 people out of tens of thousands of shareholders took part.

Although a Shanghai court awarded the shareholders in the end, their lawsuit could have been smoother had there been a wider participation and the backing of a dedicated legal clause.

Under the new Securities Law, impacted investors will become part of a class action against wrongdoers unless they choose to exit such an action. At the same time, a Shanghai court issued detailed guidance in March to simplify litigation procedures for class-action suits.

Chinese policymakers are also easing rules on stock incentive schemes for large SOEs, seeking to address an old problem of misaligned interests between their management and shareholders. More flexibility is being allowed in the design of incentive schemes, which used to follow rigid formats, while regulatory approvals are getting easier to come by.

A growing number of State-owned firms, including COSCO Shipping Ports, China Telecom and China Mobile, have recently introduced incentive plans.

Disclosure of ESG performance may become mandatory in the foreseeable future. The country's top securities watchdog, the China Securities Regulatory Commission, has been studying how to draft rules on ESG disclosures for listed firms, according to a November statement.

Although, as in many countries, the pandemic may be forcing China to prioritize growth more than anything else, it's encouraging to see a steady rise in ESG awareness largely intact. The policymakers charged with engineering China's economic recovery efforts would do well to seize this historic opportunity to deepen the country's sustainability push.

The views don't necessarily reflect those of China Daily.

Paras Anand is chief investment officer for Asia-Pacific at Fidelity International, a global asset manager. Flora Wang is director of sustainable investing at Fidelity International.

Today's Top News

- Hope, skepticism and questions ahead of Trump-Putin summit

- Xi's article on promoting healthy, high-quality development of private sector to be published

- Japan must face up to its wartime past

- Vision turns county into green model

- China rolls out new visa type for young science talent

- Cambodia, Thailand urged to engage in dialogue, rebuild trust