Can e-commerce grow retail sales beyond inbound travelers?

According to retailers surveyed, Mavis Hui, Hong Kong and Chinese mainland consumer sector analyst at DBS Hong Kong, observed that pre-pandemic travelers' tourism spending on tourism-centric merchandise could contribute 40 to 50 percent of a single store's sales. For stores located in core shopping districts like Tsim Sha Tsui, that could exceed 70 percent. Most tourist spending is not e-commerce based; they are in-shop purchases.

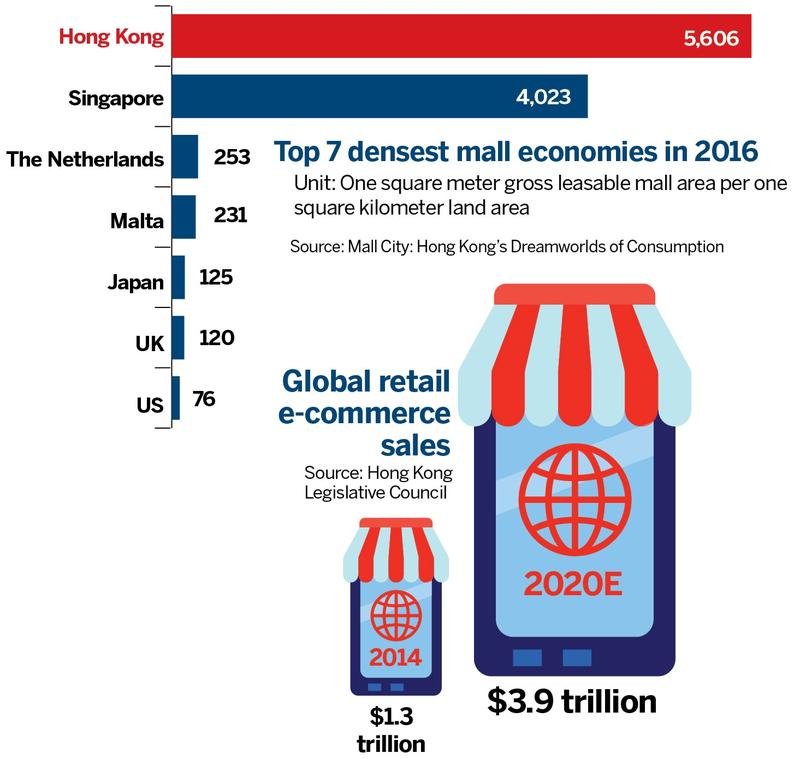

Hui said the robust growth in e-commerce as a percentage of total retail in Hong Kong reflects the reduced base from loss of tourism-driven retail sales, not necessarily a significant local spike in e-commerce. However, the number of hours that people spend online has risen from an average of six hours to over seven hours per day, which is an encouraging indicator.

"E-commerce is here to stay for locals, but unlikely to hit the high penetration in Europe, the United States, or the Chinese mainland, for years to come," Yip said. "The future of the retail sector in Hong Kong is dependent on the number of tourists the city can attract when the pandemic ends. This requires close collaboration of local government, retailers, and the hospitality industry."

Hong Kong Tourism Board data recorded fewer than 10,000 arrivals in Hong Kong over the first two months of 2021, down 99.7 percent against the same period last year. In 2020, total visitor arrivals from the mainland plummeted to 2.7 million — the 1998 level.

While some operators in the retail and tourism sectors hold high hopes for vaccinations hastening the reopening of borders to resume travel, Hui does not see a very speedy post-COVID tourism recovery to prior levels.

Michael Cheng, PwC's consumer markets leader for Asia-Pacific, the Chinese mainland and Hong Kong, highlighted a mix of structural issues facing Hong Kong retailers in high rent, labor cost, and other operating expenses, that erode their price differentiation against mainland retail from 30 to 10 percent.

- Commemorative events, exhibitions held in Jiangsu to mark 80th anniv. of victory against Japanese aggression, fascism

- Chinese scientists develop non-invasive blood sodium tracker

- International deep space group founded in Anhui

- China activates emergency response to flooding in Zhejiang, Fujian

- Scientists discover how H5N1 virus invades cattle

- Nation drives global rail innovation ambitions