Cash remittances from US to face tax

Every month, Joanne Nichols, 66, from Queens, New York, visits a small money transfer business in Brooklyn where she uses cash to send money abroad to her family in her native St. Lucia, in the Caribbean.

"I have a daughter back home and even though she's grown up, I send her money from time to time. Not as much as I used to before, years ago, but I like to help out," Nichols said.

But starting on Jan 1, 2026, under the One Big Beautiful Act, passed in July, anyone who sends a cash remittance transfer to a foreign country will have to pay an excise tax of 1 percent on that transaction.

The fee, payable to the government, will be in addition to other costs. Nichols thinks the fees "are already too high". She said she'll likely send less money abroad if she has to pay more.

For decades, the US has consistently been the top remittance-sending country in the world, according to the 2024 World Migration Report by the International Organization for Migration, or IOM.

At least $79 billion worth of remittances were sent from the US to other countries in 2022.

India, Mexico, and the Philippines are among the top destinations that receive US dollars, according to IOM's report published last year.

African nations received nearly $10 billion in remittances from the US in 2024, the World Bank estimates. Latin America and the Caribbean received $161 billion in 2023, mostly sent from the US, the Inter-American Development Bank found.

Helen Dempster from the Center for Global Development describes these money transfers as "a crucial source of household income and economic stability for low- and middle-income countries".

Neal Allen, 52, from Brooklyn, New York, is originally from Jamaica in the West Indies. He sends money back to his family and friends in his home country at least once a month.

"The money is very much important," Allen said. "They mostly buy food, clothes and necessary things with it. I send money back about one time per month. I heard about the fees. Like, if you send $100, it takes $10 to send it.

"If I could get cheaper fees, naturally, I'd like that. I'd send more."

New York City is home to over 3 million people who are foreign-born, the mayor's office said. Many strive to maintain important links to their home countries.

Across all five boroughs, independent businesses that offer remittance services like Western Union or MoneyGram are a familiar sight.

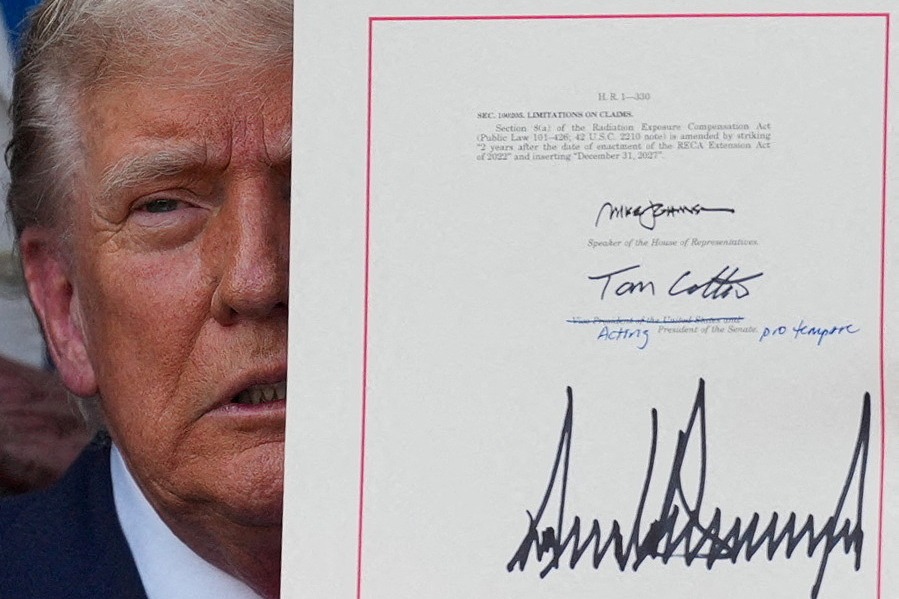

Under the initial proposals in the budget bill, the excise fee was due to be 3.5 percent, but this was later lowered to 1 percent by the time it was signed into law by President Donald Trump on July 4.

Section 4475 of the tax act states that the exact amount paid in remittance fees will depend on how much is transferred.

The fee only applies to "cash, a money order, a cashier's check, or any other similar physical instrument to the remittance transfer provider".

Money sent from a US bank account, online, with a debit or credit card, or from a retirement or brokerage account is exempt.

The sender of the money, regardless of US citizenship, is responsible for paying the tax and the remittance transfer provider must collect it for the Internal Revenue Service.

Most people who send remittances have already paid income tax on their earnings. The average transfer fee is estimated at 6.4 percent, the Financial Times reports.

Americans for Financial Reform, a nonprofit organization, found that "in the last three years, some of the most financially vulnerable people in the US, lower-income immigrant workers, lost $15.4 billion in hidden exchange rate markups — about 20 percent of the value of total transfers — when they sent money home to support their families".

belindarobinson@chinadailyusa.com