|

|

|

|

Editor's note:

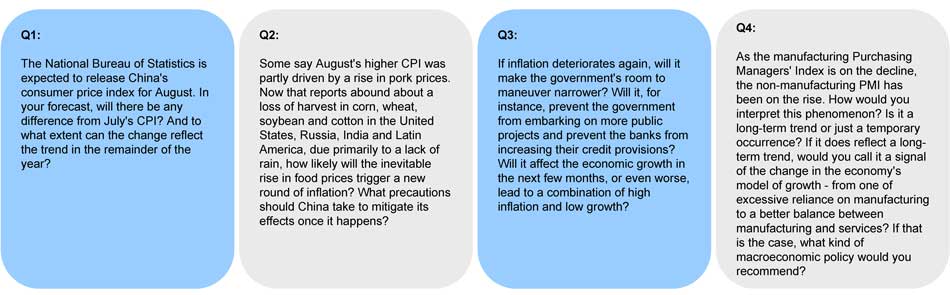

Economists dished out their own forecasts before the official release of the August consumer price index, a key measurement of inflation. Most have put their CPI estimates above 2 percent year-on-year, higher than July's 1.8 percent. Although it is too early to say inflation is looming large again, after it was brought down from 4.5 percent in January, the loss of harvests for farmers in many countries in the world is almost certain to drive up global food prices. So no one can say CPI's rise in August was but an independent phenomenon or that the index won't climb still higher in the next few months. How high China's CPI will be at the turn of the year is really hard to tell. Putting things in this perspective, the central government still has a couple of months before inflation becomes worse, to increase the money supply and boost the economy's short-term growth. The National Development and Reform Commission's latest approval of a number of cities' urban rail projects, worth more than 700 billion yuan ($110 billion) in total, is an example of the government strategy at work. In a country where half of the population is still counted as rural and many small towns are shabby, improving urban infrastructure can add some fuel to the economy's growth. But as to how much more growth the country wants, how many side effects (such as inflation) it can tolerate in the meantime, and how consumer spending, rather than government investment, can play a bigger role in driving the economy forward are long-term issues still to be decided after the top leadership transition.

Previous Issues:

|

|

|

In addition, global commodity prices are bouncing back, and the NDRC raised oil prices last month. Consumer prices may continue to rebound in the coming months, to an expected 2.6 percent in the fourth quarter from 2 percent during the July-to-September period.

Prices of agricultural products in the global markets have been rising quickly recently, but their effect on food prices in China have been limited. Regarding the supply of agricultural products, those consumed the most, such as grain, meat and sugar, have a low dependency on imports. For example, imported rice was only 0.3 percent of total consumption, while that of meat was 2.3 percent in 2011. Thus, agricultural product prices respond mainly to changes in domestic demand and supply. Some products, including soybeans and edible oil, can be largely influenced by international markets.

We believe that stabilizing economic growth is much more important in the short term. The central bank still has some room to ease monetary policy, including cutting interest rates and lowering the reserve requirement ratio. September is expected to be a good time to cut interest rates again. The government is adopting a cautious attitude toward the stabilizing measures. Adjusting the growth structure remains the most important target for policymakers. The government hopes to avoid a large number of stimulus policies, which could have a negative effect on the growth pattern transformation. Authorities are trying to stabilize growth while restructuring the economy, which seems contradictory in the short term, but the two goals coincide in the long run. The current levels of employment and inflation are still tolerable to the government. The traditional stimulus policies, such as increasing public investment, are constrained by the slowed fiscal income this year. Meanwhile, the drop of the government's land-transfer income and banks' prudent lending strategy have also reduced the possibility of huge stimulus plans. Besides, the government should accelerate structural tax reduction and enlarge the private capital investment scale.

In the long term, the service industry is expected to rise further in the economic structure. However, the upgrading and transforming of manufacturing businesses is essential to support sustainable growth. The government can further cut taxes for companies and encourage more private capital into the manufacturing sector, as well as improve the market-based interest-rate reform. Those measures can support the steady growth of profits and promote investment efficiency.

Chief Economist and Head of Greater China Economic Research with JPMorgan Chase & Co |

|

|

The issue here is not the CPI itself, but the fact that the acceleration of food-price inflation will re-ignite inflationary expectations. That's why as of now, stringent administrative controls on the property market remain in place in spite of the intensifying weakness seen in the manufacturing sector.

Given China's comparatively high GDP growth, moderate CPI inflation below 3 percent should be tolerated. China has so far played its cards right. Its vigilant attitude toward monetary loosening makes sense, considering the high possibility of QE3 and an imminent rebound in CPI amid higher local and global food prices. I don't think the government needs to take any measures right now.

China can spur growth easily by removing the numerous restrictions on the property market. The fact that it has not chosen the easy route shows the improving maturity of macroeconomic management that does not aim only at propelling short-term growth but also at preventing structural problems from deepening further.

China's slowdown is driven by sluggish external demand and deceleration of fixed-asset investment. The former is involuntary, but the latter is an intended policy outcome. The primary economic weakness is clearly in the exports-related manufacturing sector, and that naturally calls for a weaker currency. As a result, the 0.7 percent year-to-date depreciation of the renminbi is a logical policy response. However, moderate periodic depreciation of the renminbi will not lift exports noticeably.

-----Chris Leung |

|

|

Meanwhile, if the CPI rebound is above 3.5 percent, the government's choices to stimulate economic growth will be quite limited. It is unknown whether the measures the government took during 2008 and 2009 will have the same effect this time.

Meanwhile, as the weakening manufacturing PMI is directly related to the economic slowdown among China's major trading partners, the government doesn't have many ways to help out.

Director of international economics, Institute for International Economic Research, |

|

|

We expect prices to have risen again in August too. Considering domestic oil prices also went up compared with July, nonfood prices are likely to show some increase too. In summary, although these basis factors will drag down CPI by 0.31 percentage point, the index will probably rebound to 2.3 percent in August.

But bear in mind, even disastrous weather conditions here and elsewhere in Asia and recent hikes in oil prices have failed to affect the market in any significant way. As long as we don't see any big changes before the end of the year, we are maintaining our forecast that CPI will remain at 2.8 percent throughout 2012. Even if prices continue to increase, inflation pressures are still less than last year. However, we do expect prices next year will probably continue to rise.

But certainly any decision aimed at monetary easing should not simply focus on maintaining the status quo. Rising inflation pressures next year should be taken into account in any decisions being taken. We forecast there should be another cut in interest rates by the end of the year, along with a lowering of the reserve requirement, at least once, maybe twice.

Improvements in non-manufacturing sectors have been attributed to official efforts to stimulate consumption, along with more investment and faster growth in personal incomes. All of these signs might indicate a long-term trend, but we need more time to observe. The economy will probably stay at a lower level of growth, judging by domestic economic performance in July and August. Because no further measures have been announced yet to spark life into the economy, the market is still cautious and in a "wait-and-see" mode. Declining demand at home and abroad is still the main reason for the economic slowdown. In the third quarter, uncertainties in major economies, such as the US, Japan, and Europe, will continue to affect emerging markets, and export difficulties being experienced in China are likely to get worse. In terms of investment, the probability is that the authorities will adopt a low-key package of stimulus measures, focusing on injecting life into local economies, which have been affected. We predict the government's fine-tuning measures will be targeted, but not aggressive. Due to very weak market confidence, measures to stabilize economic growth staged in the second quarter may start to show effects by the end of the year. GDP growth probably will show a slight recovery in the third quarter from three months earlier. -----Lian Ping |