Mainland stock markets rose on Wednesday, led by real estate companies and securities firms, sending the benchmark index farther into bullish territory.

The Shanghai Composite Index climbed 1 percent to 2382.48 points, reaching its highest level in nearly eight months.

The Shanghai index has risen 22 percent since Dec 3.

The Shenzhen Component Index closed at 9783.84 points, up 0.82 percent, while the Hang Seng China Enterprises Index of mainland companies traded in Hong Kong increased 0.78 percent.

The increases were driven by positive news from the real estate industry and from the China Securities Regulatory Commission, analysts said.

Dacheng Fund Management Co Ltd, a Shenzhen-based brokerage, predicted that China's stock markets will keep rising in 2013 on continued economic recovery.

According to data from Homelink, a major Chinese property brokerage, Beijing's sales of commercial property in January reached 10,032 units, up 570 percent year-on-year.

Property stocks rose 2.11 percent on the news, led by the shares in Gemdale Corp - China's third-largest property developer by market value - which increased 9.8 percent.

The property sector index reached a 21-month high as Fitch Ratings said that Chinese homebuilding volumes are expected to rise this year.

In addition, some analysts said that the markets gained on news that China may further open its A-share market to investors from Taiwan.

China may relax asset requirements for Taiwan brokerages seeking quotas under the Qualified Foreign Institutional Investment program, said Tong Daochi, the head of the international department of the China Securities Regulatory Commission, in Taipei.

The securities sector rose 0.97 percent on average on the news, led by the shares in China Merchants Securities Co.

The share prices of securities firms have been on the rise since Monday, supported by a number of moves pledged by the China Securities Regulatory Commission to further open up the market.

"Most of the 22 listed securities companies are like skinny monkeys," said Li Daxiao, head of research at Yingda Securities, a Shenzhen-based brokerage. "The banks are like elephants and insurance companies are like bulls. So, the securities companies have a greater potential to rise faster."

Meanwhile, Jin Yanshi, a popular economist and former investment banker, wrote on his micro blog that the first wave of China's stock market increase will be led by financial and property companies, which is happening now, to be followed by a second wave featuring telecoms and technology companies, and a third wave led by consumer and healthcare companies.

huangtiantian@chinadaily.com.cn

Property prices set to rise as supply tightens

Moody's: Credit profiles of China's property developers improved

Beijing pre-owned home sales may reach 24-month high

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

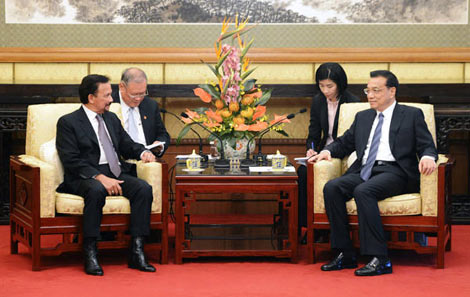

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show