A shares tipped to 'rebound'

|

|

Dariusz Kowalczyk, senior economist and strategist with Credit Agricole, said: "At this point, after the recent gains, we no longer think that Chinese equities are that cheap."

While they remain attractive based on price-earnings ratios, operating margin is relatively high, which increases the risk of a correction, and "our measure of the macroeconomic environment is not favorable either", he said.

Li Jian, an analyst with Everbright Securities, said: "Overall, I see some more upside, but it is limited. I suggest taking a cautious attitude. The Shanghai index is very likely to climb to the 2400 level before the Chinese New Year, but you cannot ignore risks, especially after some enterprises announce annual reports."

Although recent economic indices have been encouraging and indicate a recovery, corporate performance, requiring a large injection of capital, has remained in doubt.

CNBC quoted Peter Elston, head of Asia Pacific Strategy and Asset Allocation at Aberdeen Asset Management, as saying on Wednesday: "Yes, at the moment you are seeing a spurt in the Chinese stock market, but we think the best way to invest in China is through high-quality companies, Hong Kong companies that do business in China, where as an investor you know you are going to be looked after."

An examination by the China Securities Journal early last month of the projected earnings released by China's 1,045 A-share listed companies showed that 960 firms said their combined net profits are likely to range between 145.74 billion yuan - representing a 13.78 percent decline year-on-year - and 174.53 billion yuan, indicating only a slight rebound of 3.24 percent.

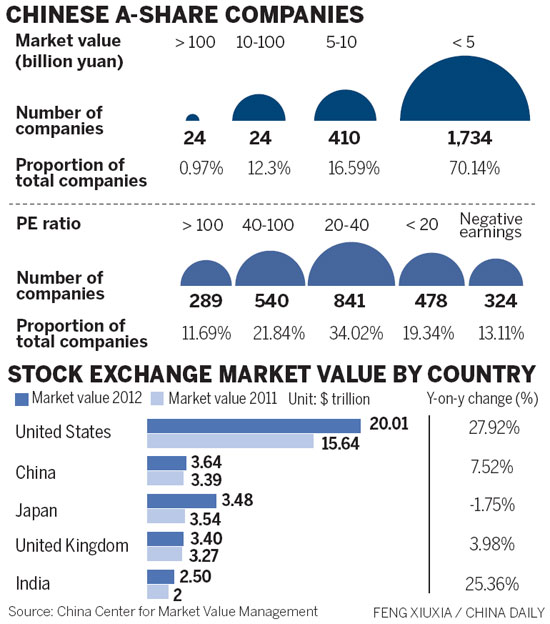

The market value management report said private companies are showing a stronger vitality than State-owned enterprises, as their valuation and market value both grow faster than the latter's.

A report by HSBC on Wednesday said stock investment is promising in 2013, especially in emerging markets - particularly China - where valuation is relatively low if calculated by price to net asset value ratio.

xieyu@chinadaily.com.cn

Don't miss

Chinese stocks close mixed on property control speculation

Mainland stocks hit record high in past 8 months

How long will the stock rally last?