Analysts are suggesting that the rally seen in Chinese real estate stocks since Dec 3 could be at an end, based on continued fears that Beijing is expected to launch some form of property tax in the first half of the year.

Real estate companies dropped as much as 20 percent in value between June 1 and Dec 3, before gaining around 25 percent since then.

"China's stock market has rebounded from Dec 3, and the housing sector has performed well," said Li Daxiao, head of research at Yingda Securities, a Shenzhen-based brokerage.

"But getting significantly better than now, may be a long way off."

The property tax speculation started on Jan 31, hitting investor confidence hard and shaving 3.67 percent off China's housing stocks on the day.

Despite the official China Securities Journal reporting that Beijing planned to postpone the expansion of a pilot program to implement a property tax, it said the government still intended to keep a tight lid on the property market through other means in major cities.

However, investors have effectively stopped buying housing stocks as a result, say analysts.

Li added, "The government is to focus on controlling the price of commercial houses, but not the housing stocks prices. But the falls in property stocks suggest that investors have lost confidence in the sector."

Li Yongzhuang, director of the Livelihood Economy Research Center at the Central University of Finance and Economics, said China's property market has shown resilience recently.

But if property prices continue to rise, home-purchase and credit restrictions will remain unchanged and the government will even launch stricter policies.

Yuan Jun, an investment analyst at Aijian Securities, a Shanghai-based brokerage, said it was still hard to say whether house prices will go up or down in 2013.

"If prices rise too fast, the government will step in to cool the housing market, and measures could last for a long period," he said.

Since Dec 3, housing stocks have rebounded, with the gauge of the housing sector increasing 24 percent up to Monday.

"The first round of stock price increases was too fast, so the sector is moving now into its adjustment stage, and I expect investors to start profit-taking now.

"It's not a good time to buy housing stocks," Yuan said.

On Monday, shares across the housing sector dropped 0.58 percent.

Li Daxiao added that given the stock market is still at a relatively low level, he expected banking, securities, insurance and housing stocks had room for further rises.

"I would say that this year's high and low points will exceed those of last year due to the recent bull run," Li said.

huangtiantian@chinadaily.com.cn

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

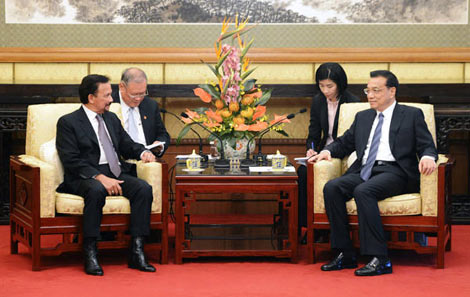

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show