Banks have reported a fifth consecutive quarterly rise in the value of their bad loans, the China Banking Regulatory Commission said on Friday.

Bad loans rose by 64.7 billion yuan ($10.4 billion) to stand at 492.9 billion yuan at the end of 2012.

However, the non-performing loan ratio showed a 0.01 percentage point fall, to 0.95 percent.

The figures also showed that in January, China's banks extended 1.07 trillion yuan in loans, the highest monthly total in the last three years, and analysts said the growth in new loans might help keep the NPL ratio at a relatively low level.

Guo Tianyong, a finance professor at the Central University of Finance and Economics, said that China's bad loans level is now in a "subtle" period in which the scale is increasing, but the overall risk is still under control.

Zhao Qingming, a financial expert, was quoted by Reuters as saying that as China's macroeconomic condition improved over the past year, both the level of China's bad loans and non-performing loan ratio might drop.

The combined net profits of China's commercial banks rose to 1.24 trillion yuan ($197.5 billion) in 2012, an increase of 18.9 percent from a year earlier, according to the CBRC.

But the growth was much lower than 2011, which saw a 36.34 percent increase.

The capital adequacy ratio rose to 13.3 percent at the end of 2012 from 12.7 percent a year earlier. The average loan to deposit ratio was 65.3 percent, the CBRC said.

The CBRC requires major lenders to maintain a minimum capital adequacy ratio of 11.5 percent, while other banks need to keep a minimum ratio of 10.5 percent.

A higher capital adequacy ratio is generally seen as good for the financial system as lenders have more cash to cover the cost of unforeseen risks.

The downside for investors is that maintaining a high ratio can reduce profits.

Rising defaults and shrinking loan profitability present a potentially serious threat to China's banking system as the world's second-largest economy expanded at the slowest pace in 13 years, the regulator said.

zhengyangpeng@chinadaily.com.cn

Related Readings

Chinese banks' bad loans rise

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

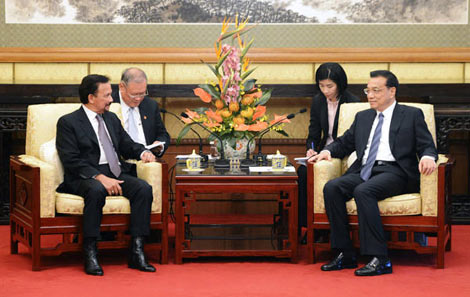

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show