|

|

A saleswoman shows off gold necklaces at a jewelry shop in Deqing, Zhejiang province. Provided to China Daily |

Yellow metal unlikely to match stellar performance of 2013, says WGC

Global gold demand declined sharply in the second quarter of the year as Chinese and Indian buyers purchased less jewelry than a year ago, the World Gold Council said on Thursday.

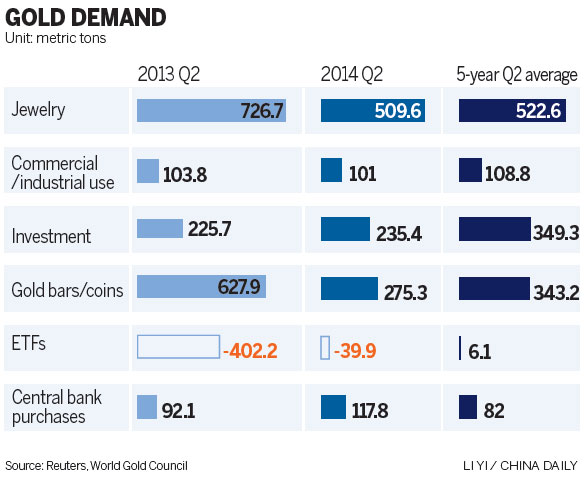

According to the WGC, global gold demand during the second quarter of 2014 was 964 metric tons, a 16 percent year-on-year drop. The WGC said the full-year results would be much lower than in 2013.

The significant drop in the year-on-year demand is not "unsurprising", as the gold boom in 2013 was an exceptional case, the WGC said, adding that it would be difficult for the 2014 numbers to surpass the 2013 levels.

Global jewelry demand, which represents more than half of total global demand, fell 30 percent year-on-year to 510 metric tons. However, jewelry demand during the second quarter was 11 percent higher than in the second quarter of 2012, extending the broad upward trend evident since 2009, the WGC said.

"Year-on-year comparisons were affected by the surge in demand seen in the second quarter of 2013. However, demand still remains in line with the five-year average," the report said.

Albert Cheng, managing director for the Far East at WGC said: "We expect 2014 to be a year of consolidation as shown by this quarter's results. The sudden price drop in 2013 meant many Chinese and Asian consumers brought forward jewelry and bar purchases."

Marcus Grubb, managing director of Investment Strategy at the World Gold Council, said that compared with an exceptional 2013, when the market saw record consumer buying and investor sell-offs, the quarterly trend in 2014 demonstrates a return to the long-term tren

In Shenzhen, one of China's jewelry wholesale hubs, many display centers and gold jewelry factories shut shop in the first two quarters of 2014 as demand tapered off. Most of these firms shifted to other businesses, which is natural as only the strong companies and big brands will be able to withstand the market upheavals, said industry experts. "Jewelry consumers continued to digest the exceptional purchases of 2013 and investors also rebalanced, pulling back from the extremes we saw last year. Overall the gold market is stabilizing following the extraordinary conditions we saw in 2013," Grubb said. Total investment demand (combined investment in bars and coins and exchange traded funds) moved up by 4 percent to 235 metric tons during the second quarter. Gold prices moved in a narrow sideways range for much of the second quarter this year, marking a subdued environment for investors. Consequently, bar and coin demand saw a significant reduction from the record highs in 2013 Q2 even as outflows from ETFs slowed, the WGC report said. From a global perspective, the gold demand trends show that the focus is now moving from the West to the East, or in other words, from the US and Europe to Asia. "The developments in the gold market in both China (Shanghai) Pilot Free Trade Zone and the Singapore Gold Hub in 2014 are a further testament to the trend that the world's gold demand is moving from the West to the East," said Cheng from WGC. Although geopolitical conditions may impact the short-term gold price, in the long run, prices depend on supply and demand, said experts. Yang Fei, Shanghai-based gold investment analyst said that although gold is seen as a financial product, it is also a commodity and as such its prices depend on demand. "Investors keep gold in their portfolios to hedge against risks from currency fluctuations and capital market volatility", said Yang.

China's local GDP data points to recovery, rebalancing

10 Chinese cities that lifted property curbs in July