|

|

A member of a Chinese business delegation speaks with an employee (R) of Israeli high-tech firm ironSource at his office in Tel Aviv in this file photo. [Photo/Reuters] |

Avi Cohen, CEO of The Floor, a Tel Aviv-based incubator of financial technology firms, hosts visitors, mostly Israel entrepreneurs, all the time. But, on a recent September weekend, his guests were 30 chairpersons of Chinese firms.

"Traditionally, Israeli entrepreneurs tend to look at Western markets for growth. But that is changing with the growing interest from Chinese investors," Cohen said.

The Floor was established eight months ago. So far, it has raised $2 million from Pando Group, a venture capital fund backed by China's Bloomage BioTechnology Corp Ltd. The Floor plans to open a Shanghai branch next year.

The investment is part of a broad trend unfolding in Israel, a global innovation hotspot which has become a popular destination for Chinese capital as China works hard to upgrade from a manufacturing hub into a tech beehive.

"Currently, every week, there is a Chinese delegation visiting Israel. They can be entrepreneurs, scholars or government officials," an official at the Chinese Embassy in Tel Aviv told China Daily.

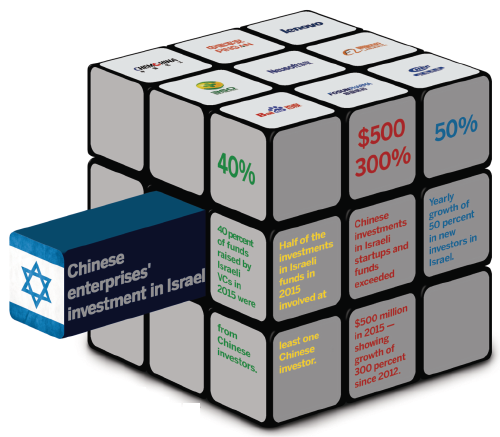

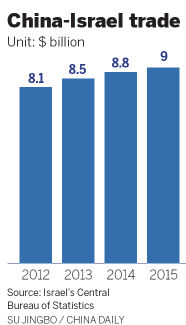

In 2015, Chinese investments in Israeli startups and funds exceeded $500 million, showing a growth of 300 percent since 2012, data from the Israeli Ministry of Economy and Industry shows.

Tech giants such as Baidu Inc and Alibaba Group Holding Ltd, as well as players in traditional industries, have all joined the race. Last year, Chinese firms contributed 40 percent of money raised by Israeli venture capital funds.

"Israel's tech scene is a can't-miss these days," said Song Chunyu, vice-president of Beijing-based Lenovo Group Ltd. In charge of Lenovo's investment unit, Song visits Israel at least once a year.

According to him, the Middle Eastern country, which was ranked by Bloomberg as the second most innovative country in terms of R&D capabilities in the world in 2015, is highly complementary to China's economy.

"Israeli entrepreneurs are willing to spend years and decades on a specific core technology, but their growth is often limited by its small domestic market," Song said.

On the other hand, China, with a stable economy and a population of 1.3 billion, is a huge market but lacks ultra-modern technologies. "The two countries are a perfect match in the tech sector," he said.

Lenovo has so far poured $20 million into six Israeli startups, including Neura, a platform that helps users personalize connected devices while guarding their data.

It plans to invest $100 million more in local startups over the next three years to tap into Israeli talents.

Hila Engelhard, an official at the Israeli Ministry of Foreign Affairs, said: "China is like a giant computer and Israel can serve as a processor in it."

According to her, a big portion of Chinese money is flowing into areas like agriculture, medical technology mobile internet and other high-tech industries.

Chinese industrial conglomerate Fosun International Ltd, for instance, spent $240 million to acquire a 97 percent stake in Israeli medical tech firm Alma Lasers Ltd.

Last year, Baidu Inc invested $5 million in Tonara, which developed an interactive music education app, along with its Israeli VC partner Carmel Ventures. Prior to that, it invested $3 million in local video capture firm Pixellot.

The trend is fueled by the national governments' efforts to deepen bilateral ties. A 10-year multiple entry visa policy will take effect next month. The two sides will also start talks for a free trade agreement. That will be preceded by a three-year deal to promote bilateral cooperation.

Such enthusiasm was very much in evidence at the second China-Israel Innovation and Investment Summit, which was held in Tel Aviv in late September. About 100 Chinese firms and 300 Israeli companies showed up and negotiated investment proposals totaling $1.5 billion, according to the conference organizer.

Among them is Chinese social networking heavyweight Tencent Holdings Ltd, which is looking for startups in artificial intelligence, augmented reality and cloud computing.

A group of CEOs from 40 smaller Chinese manufacturing firms was also present, looking for technologies that can upgrade their factories or help build new growth engines, as they wrestle with mounting pressure of an economy whose growth rate is slowing.

Chinese IT firm Neusoft announced at the start of the conference with Israeli-Chinese private equity fund Infinity Group that it would jointly set up a $250-million fund to invest in Israeli medical technologies over the next three years.

Shen Meng, director of Chanson & Co, a boutique investment bank in China, said a few Chinese startups do have "core technologies", but have been over-valued, pushing up the investment cost, which is prompting investors to look for the real gold in Israel.

"But China's budding businesses that are competitive won't suffer from this trend. After all, China has a lot of investable funds now. What we really lack are good ventures," Shen said.

Eran Wagner, general partner of Israeli VC fund Gemini, said Chinese firms often adopt two approaches to investing in Israel: they either pour money into local VC funds whose network can help them effectively reach early-stage startups or directly pump capital into late-stage firms that have mature technologies and products. "Chinese investors prefer later-stage firms."

But as China is moving rapidly from being a manufacturer to a global R&D center, the appetite for risk and willingness to fund technologies that are not fully developed, are growing, he said.

Compared with their Western counterparts, however, deep-pocketed Chinese firms are still newcomers to the Middle Eastern country. The language barrier-English and Hebrew are predominant in Israel-cultural differences and a different startup ecosystem all add up to the challenges that Chinese investors face.

"It is quite important to develop trustworthy local advisors to navigate the differences between the two countries," said Chen Hongwei, executive director for Tencent's mergers and acquisitions.

Things are already moving in that direction rapidly. Legal firms, HR firms that supply workers, translators and guides, and platforms connecting Israel and China, are mushrooming.

Geekpark and 36Kr.com, two popular Chinese technology websites, rolled out Israeli business trip projects last month for small Chinese firms keen to visit Tel Aviv for investments.

Wang Xin, a Chinese student at Hebrew University, is itching to jump on the bilateral tech bandwagon. "I wanna stay in Israel to help deepen China-Israel business connections upon graduation. This is an opportunity too precious to miss."