Purchase of $5.7 billion shows options are limited

BEIJING / NEW YORK - China purchased another $5.7 billion of US Treasuries in June, an investment described by one expert as "the best of a bad bunch", amid growing calls for the country to diversify its foreign reserves.

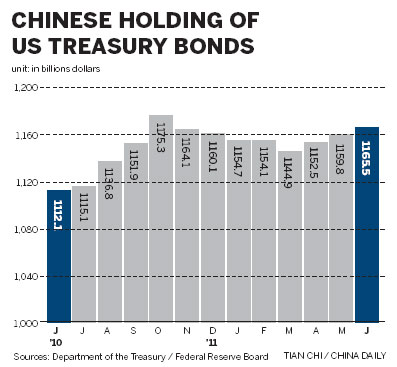

June was the third consecutive month that China increased its holdings in US Treasury bonds, despite concerns over the safety of dollar assets.

The new purchase boosted China's holdings to $1.17 trillion as of the end of June, a period when global investors were worried about the outcome of the US debt ceiling debate.

China added to its holdings by $7.6 billion in April and $7.3 billion in May, according to data from the US Department of the Treasury.

|

|

As the largest creditor of the US, China has been closely watched for its investments in dollar assets, especially after Standard & Poor's downgraded the credit rating of the US.

Japan, the second-largest holder of US Treasuries, reduced its holdings by $1.4 billion in June, leaving them at $911 billion. Britain boosted its holdings from May's $346.8 billion to $349.5 billion in June.

Yuan Gangming, a researcher at the Center for China in the World Economy at Tsinghua University, said the purchasing of US Treasuries reflects China's limited choice regarding its $3.2 trillion foreign exchange reserve.

"Increasing the holdings despite the slow economic recovery in the US and signs of looming debt problems is 'choosing the best of a bad bunch', meaning there are no better places for China to put such a large amount of money," Yuan said.

Yuan believes that activity in US Treasuries by Japan and Britain has more to do with their own domestic situation rather than the actual value of the bonds.

Although the US economy has been overshadowed by the rating downgrade, the country's fundamentals in the long term remain strong, Yuan said.

Ken Peng, senior China economist with BNP Paribas, said increasing the holdings in US bonds is not too significant.

"What really matters is the proportion of China's newly increased US dollar assets (including Treasury bonds) to the newly increased foreign exchange reserves," he said. "Though there is no way to get the figure, we estimate that the proportion is gradually dropping."

He said that the key method to address China's foreign reserves dilemma is to achieve a trade balance.

"If the country's foreign exchange reserves continue to grow at a fast pace, there is little chance of getting out of the cycle," Peng said. "You have to do something with the accumulated dollars."

China's trade surplus surged to $31.5 billion in July, the highest level in more than two years, as exports rose to a record level, the General Administration of Customs said last week.

Analysts said that while there is not much that China can do in the short term with its foreign reserves, it should nonetheless try to diversify.

"Gold probably tops the list, besides euro-denominated assets and debt of the emerging markets," said Yao Wei, China economist with Societe Generale in Hong Kong.

"The share of gold in China's foreign exchange reserves is significantly lower than other countries. The pace of diversification will be subject to the situation in global financial markets and China's own currency reform."

Zhu Zhiqun, a professor of political science and international relations at Bucknell University in Pennsylvania, said China should be "more creative" and diversify investments.

"Chinese companies can help failing US businesses through acquisitions and purchases. The US Congress is likely to block Chinese investment in key sectors related to US national security, such as the oil industry, but it is not opposed to Chinese investment in less sensitive businesses," Zhu said.