Crisis creating ODI opportunities

Updated: 2011-09-07 09:06

By Ding Qingfen (China Daily)

|

|||||||||||

|

|

|

Attendants Huang Tingting (right) and He Jiao share a light-hearted moment on Tuesday ahead of the opening on Wednesday of the 15th China International Fair for Investment & Trade in Xiamen, Fujian province. [Photo / China Daily] |

Countries 'more receptive' to investment amid global downturn

XIAMEN, Fujian - The global debt crisis presents opportunities for Chinese companies planning to invest overseas amid enticing prospects for outbound direct investment (ODI), the Ministry of Commerce said on Sept 6.

|

|

China's ODI for July fell 58 percent year-on-year to $3.7 billion, the first monthly decline this year, as investment into the US, the EU and Japan dropped, according to the ministry.

The global situation did hurt ODI, ministry spokesman Shen Danyang said prior to the opening of the 15th China International Fair for Investment & Trade.

But now is a "fairly good time" for Chinese companies to go overseas, he said.

The largest investment fair in China has attracted 636 international organizations and 482 heavyweight participants from foreign governments, companies and institutions.

The five-day fair officially opens on Sept 7 in Xiamen, Fujian province.

"There is widespread enthusiasm over the fair An increasing number of countries welcome Chinese investment," Shen said.

From January to July, China's ODI in the non-financial sector increased just 3.3 percent year-on-year to $27.6 billion.

But Wang Shengwen, deputy director-general of the ministry's Department of Outward Investment and Economic Cooperation, said earlier that ODI this year would probably see "double-digit" growth.

"As a result of the debt crisis, restrictions on foreign investment will be reduced and more nations are becoming receptive to ODI," Wang said.

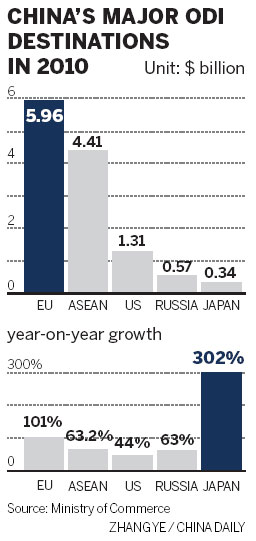

In 2010, China's investment into the EU more than doubled to $5.96 billion. Investment into the US surged 44 percent and ASEAN and Russia saw increases of about 60 percent. Japan recorded a massive jump in Chinese investment of 302 percent.

"Chinese investment into the EU will continue to grow rapidly in 2011," Shen said.

A report released by the ministry on Sept 6 showed China leapfrogging Japan and the United Kingdom to be the fifth-largest overseas investor in 2010, with ODI increasing 21.7 percent to $68.8 billion last year.

By the end of 2010, China's total ODI was $317.2 billion, making it the 17th-largest global investor.

"China's ODI has witnessed rapid growth during the past three years," Shen said.

From 2008 to 2010, China's combined ODI was more than $180 billion.

The largest deal in 2010 was made by Sinochem. The State-owned energy and trading group invested $3.1 billion for a 40 percent stake in Peregrino offshore field near Rio de Janeiro from Norway's Statoil.

By 2010, the Asia-Pacific and Latin America were the top two destinations for China's ODI. Investment in the Asia-Pacific accounted for 71.9 percent, with Latin America accounting for 13.8 percent.

But the EU and Oceania witnessed the most rapid growth. By 2010, China's total investment into Oceania was $8.61 billion, a 13-fold increase from 2005.

Investment into Australia from January to July saw a huge leap of 102.5 percent.

"The US, the EU, Australia and emerging economies will be a priority for Chinese companies going overseas," Wang said.

By 2010, 88.3 percent of China's overseas investment, worth $280.2 billion, went into six major industries: commercial services, finance, retail, mining, transportation and manufacturing.

But China's ODI is still in a "fledgling state", Shen said.