|

|

|

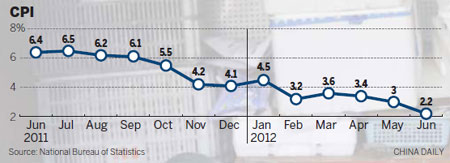

Easing inflation, fueled by falling food prices, leaves the government ample room to introduce more measures to boost the slowing economy. [Photo/China Daily] |

Government given flexibility to introduce pro-growth measures

The government is expected to take measures to boost growth by further loosening monetary and fiscal policy as inflation eased to a 29-month low in June.

Consumer prices climbed at their slowest pace in more than two years last month. There was also data from the manufacturing front, with the cost of producing goods falling to a 31-month low.

Economists believe the figures suggest that the world's second-largest economy may have suffered its sharpest second-quarter slowdown since the 2008 financial crisis.

The producer price index (PPI), a main gauge of inflation at the wholesale level, fell 2.1 percent in June from a year earlier. It was the lowest reading since December 2009.

The numbers signal that demand for goods from the factory sector - especially from foreign customers - is declining as the global economy weakens.

The June consumer price index (CPI), a main economic indicator of inflation, increased by 2.2 percent from a year earlier, the slowest growth since February 2010. The figure, released by the National Bureau of Statistics on Monday, was 0.8 percentage points lower than the May data.

The first half of 2012 has seen inflation increase by 3.3 percent, against the same period last year. This is lower than the full-year target of 4 percent set by the government in March.

"Inflation may drop to less than 2 percent in July, which gives more space for the authorities to readjust macroeconomic policy," said Ba Shusong, an economist with the Development Research Center of the State Council.

Asia's major exporters showed further signs of a slowdown.

As export demand shrinks because of the eurozone crisis and generally weak global economy, China's GDP growth may cool to 7.5 percent - the slowest pace since the second quarter in 2009, following an 8.1 percent year-on-year increase in the first three months, according to economists.

The drop in inflation was one of the reasons for the central bank to cut interest rates twice in one month, Ba said.

The People's Bank of China lowered interest rates in early July by 25 basis points to bolster growth.

This follows a cut in June. It also cut the reserve requirement for commercial banks by 150 basis points since November, giving the economy a 1.2 trillion yuan ($190 billion) credit injection.

Inflation will probably be lower in the July-to-October period and the interest rates cut will boost growth, Lu Zhengwei, chief economist at Industrial Bank, said.

According to the NBS, the PPI fell further below zero for the fourth straight month, showing industrial deflation, which indicated weakening demand for output, both overseas and domestic.

"In fact, the looming risk of PPI deflation highlights weak aggregate demand, and not just softening global commodity prices," a report from HSBC Holdings said.

Qian Shaotian, sales manager of Shanghai Yuanzong Hardware Co Ltd, which focuses on European exports, said that the number of overseas orders continues to drop.

"I haven't seen a great improvement on export volumes so far," Qian said.

"I hope that the government reduces tax for trading companies to save costs," Qian said.

The NBS, together with China Federation of Logistics and Purchasing, released the June Purchase Management Index on July 1.

This is an indicator of manufacturing activity. It read 50.2, the lowest in seven months. Any reading below 50 indicates contraction, above, expansion.

The second quarter's GDP figures are scheduled to be released on Friday, and they "should not be a total surprise to markets", HSBC said.

"The price of our products keeps declining because China is no longer the only place with lower costs," said Ye Jianqing, chairman of Wenzhou Zhenqing Optical Co Ltd.

Ye added that producing products of better quality, and charging accordingly, seemed to be the best way out of the situation.

Huang Yiping, chief economist in Asia with Barclays Capital, said that the central bank is likely to cut the reserve requirements for banks in July and October.

Public investment may pick up in the coming months as the government has felt greater urgency to loosen policy, according to Zhang Zhiwei, chief economist with Nomura Securities Co Ltd.

Contact the writers at chenjia1@chinadaily.com.cn and yuran@chinadaily.com.cn

Washington to remain focused on Asia-Pacific

Washington to remain focused on Asia-Pacific RQFII target blue chips amid bear market

RQFII target blue chips amid bear market Australian recall for top two exporters

Australian recall for top two exporters China fears new car restrictions

China fears new car restrictions