China's banking giants are shoring up their capital buffers at a record pace as bad loans spike to the highest level since the global financial crisis.

Lenders including Industrial & Commercial Bank of China Ltd and China Construction Bank Corp have sold an equivalent of $27.4 billion of securities that can be counted toward capital this month, data compiled by Bloomberg show. At least another $63.3 billion, which includes preference shares, is in the pipeline, according to Royal Bank of Scotland Group Plc, as banks jostle to get offerings away before the Golden Week holiday in early October.

Nonperforming loans in China touched a five-year high of 694.4 billion yuan ($113 billion) on June 30, 1.08 percent of total advances, making it more urgent for banks to build capital cushions against losses. Shares of China's five biggest banks trade at an average of five times estimated earnings, the least among lenders globally.

"Regulators continue to introduce tougher capital rules even as profit growth slows and provisioning for bad loans rises," said Tang Yayun, a Shanghai-based analyst at Northeast Securities Co. "Chinese banks face restrictions in selling new shares to replenish capital, so it's natural they'll have to rely on other instruments."

China CITIC Bank Corp sold 37 billion yuan of 10-year Tier 2 notes with a 6.13 percent coupon last week, Bloomberg-compiled data show. The Baa2-rated lender's average weighted fixed coupon on outstanding yuan-denominated bonds is 5.35 percent. Basel III securities typically pay higher yields because the notes will be written off or converted to equity if the borrower's balance sheet deteriorates to a point of non-viability.

ICBC, the nation's largest lender, hired seven banks to offer subordinated securities that will qualify as Tier 1 capital last week, while Bank of China Ltd. is also planning a sale of similar hybrid instruments, people familiar with those matters said. China's fourth-biggest lender sent out requests for proposals and met with 18 banks earlier this month in the process to select underwriters.

Tier 1 capital consists of common equity and additional securities that have equity-like characteristics, such as having no fixed maturity and being subordinate to most other claims. Under China's Basel III rules, systemically important banks need a minimum Tier 1 capital ratio of 9.5 percent, with total buffers of 11.5 percent, before the end of 2018. Tier 2 capital includes items such as undisclosed reserves and subordinated term debt. It generally absorbs losses only in the event of a winding up of a bank.

"Given the size of the Chinese banks and the growing need for them to shore up capital, whether as a result of higher nonperforming loans or asset growth overseas, we expect the offshore bond market in Asia to be increasingly Chinese," said Swee-Ching Lim, a Singapore-based credit research analyst at Western Asset Management Co, which manages some $469 billion. Lenders are "playing catch up" to Chinese corporations, which have been very active in Asia's dollar bond market, he said.

Non-bank US dollar note sales in China total $41.7 billion since January, more than one third of the $122.4 billion issued in Asia ex-Japan year-to-date, Bloomberg data show. Developers dominate, with Guangzhou R&F Properties Co leading $16.3 billion of offerings.

"There'll be demand for the Chinese banks, especially given they're among the top 10 largest banks in the world by assets," said Lee-Shin Koh, a Hong Kong-based director of capital markets origination at Citigroup Inc. "Many global investors don't yet have exposures to Chinese banks to match their size and global importance."

|

|

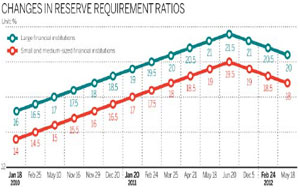

| Nation's big five banks plan bond sales in order to boost their capital | More lenders make RRR cuts |