PetroChina falls below IPO price

Updated: 2008-04-19 09:39

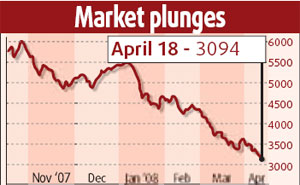

SHANGHAI: Investor confidence took a severe blow on Friday as shares in PetroChina, one of the largest companies on the Shanghai bourse in terms of capitalization, sank below their issue price for the first time, dragging the benchmark index under the psychological 3100 barrier, to its lowest point since March of last year.

The Shanghai Composite Index fell 128.07 points, or 3.97 percent, to close at 3094.67, with turnover falling to 56.1 billion yuan ($8.02 billion), down 12.1 percent on the previous trading day.

The index posted its biggest weekly drop since 1996, after falling 11.4 percent.

The smaller Shenzhen Component Index also slumped on Friday, ending down 3.13 percent at 11292.04 points, with turnover down 12.8 percent at 24.8 billion yuan.

PetroChina fell 5.04 percent to 16.02 yuan, the first time it had dropped below its October initial public offering price of 16.70 yuan.

Shares in PetroChina have dropped an aggregate 67.03 percent since Nov 5, from its offset trading price of 48.60 yuan on the Shanghai Stock Exchange.

Zhang Xiaojun, an analyst at CITIC's China Securities, said: "Shares in PetroChina are likely to drop further in the coming months, because there is still about a 100 percent price premium over its H-share price.

Big caps in the steel, property and energy sectors also took a beating on Friday.

Analysts said investors' deepening worries about the expected fall in corporate earnings resulting from the surge in the price of crude oil and other industrial materials have continued to weigh down stock prices in those sectors.

The first-quarter reports released by several investment funds on Friday indicated a sharp unloading of share holdings in recent months.

The sell-off by funds could further dampen investor confidence, analysts said.

The weak performance of many funds in the first quarter is widely expected to trigger a new wave of redemptions, forcing further unloading of shares by funds, they said.

"Portfolio adjustments by investment funds indicating a sharp reduction in share holdings have magnified the bearish sentiment," Zhang said.

"A bearish mood tends to be exacerbated by the weak performance of funds." the analyst added.

|

||

|

||

|

|

|

|