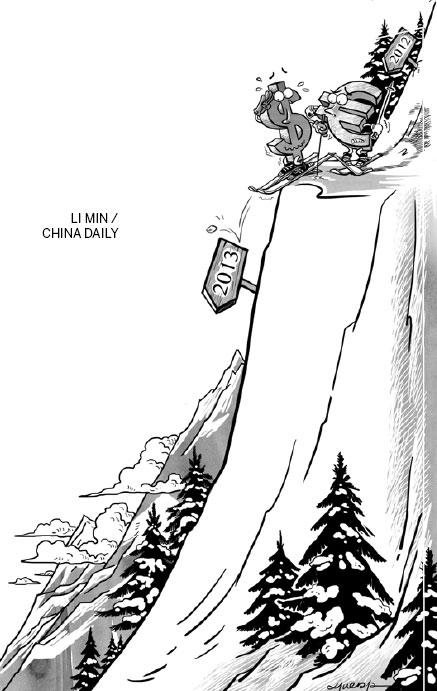

The year 2012 turned out to be as bad as I thought. The recession in Europe was the predictable ,and predicted, consequence of its austerity policies and a euro framework that was doomed to fail. America's anemic recovery with growth barely sufficient to create jobs for new entrants into the labor force was the predictable, and predicted, consequence of political gridlock, which prevented the enactment of US President Barack Obama's jobs bill and sent the economy toward a "fiscal cliff".

The two main surprises were the slowdown in emerging markets, which was slightly sharper and more widespread than anticipated, and Europe's embrace of some truly remarkable reforms though still far short of what is needed.

Looking to 2013, the biggest risks are in the US and Europe. By contrast, China has the instruments, resources, incentives, and knowledge to avoid an economic hard landing and, unlike Western countries, lacks any significant constituency wedded to lethal ideas like "expansionary austerity."

The Chinese rightly understand that they must focus more on the "quality" of growth rebalancing their economy away from exports and toward domestic consumption than on sheer output. But, even with China's change in focus, and despite adverse global economic conditions, growth of around 7 percent should sustain commodity prices, thereby benefiting exports from Africa and Latin America. A third round of quantitative easing by the US Federal Reserve could help commodity exporters as well, even if it does little to promote US domestic growth.

The US, with Obama re-elected, is likely to muddle on, much as it has for the past four years. Inklings of recovery in the real-estate market will be enough to discourage dramatic policy measures, like a write-down of principal on "underwater" mortgages ,where the outstanding loan exceeds the market value of the house,. But, with real, inflation-adjusted, house prices still 40 percent below the previous peak, a strong recovery for real estate ,and the closely related construction industry, seems unlikely.