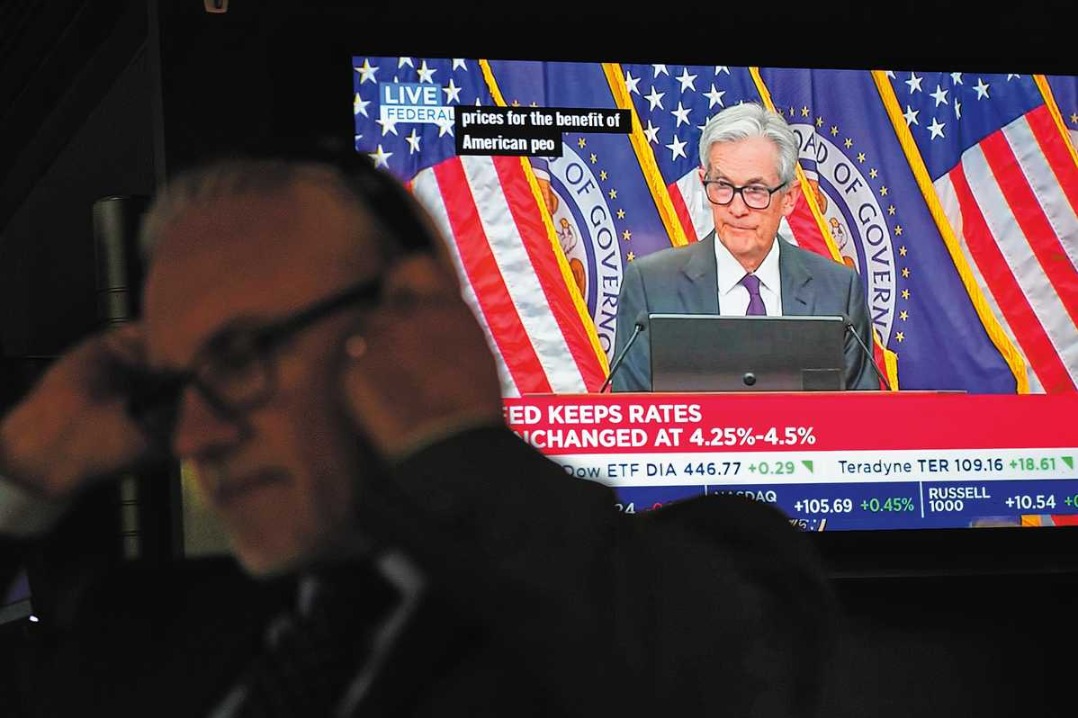

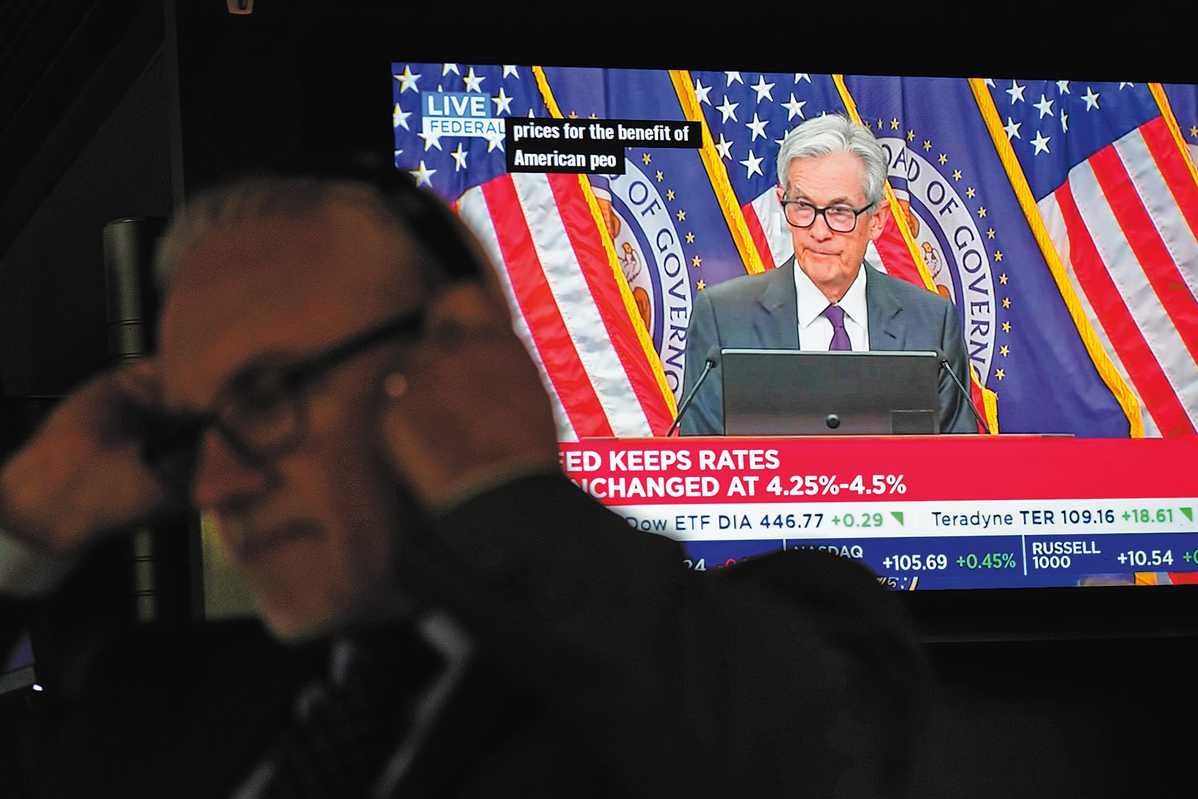

US Fed stands firm on rates amid pressure from Trump

Powell stresses inflation control, commitment to employment

NEW YORK — The US Federal Reserve on Wednesday kept the target range for the federal funds rate unchanged at 4.25 to 4.5 percent, though it faces stark pressure and harsh criticism from the Trump administration.

"Although swings in net exports continue to affect the data, recent indicators suggest that the growth of economic activity moderated in the first half of the year. The unemployment rate remains low, and labor market conditions remain solid. Inflation remains somewhat elevated," said a statement by the Federal Open Market Committee.

Uncertainty about the economic outlook remains elevated, said the statement.

The US economy expanded at an annualized rate of 3 percent in the second quarter, compared with a contraction of 0.5 percent in the first quarter, according to data released on Wednesday by the US Commerce Department.

The FOMC added that it is "strongly committed to supporting maximum employment and returning inflation to its 2 percent objective".

Federal Reserve Chair Jerome Powell said the Fed is focused on controlling inflation — not on government borrowing or home mortgage costs that President Donald Trump wants lowered — and added that the risk of rising price pressures from the administration's trade and other policies remains too high for the central bank to begin loosening its "modestly restrictive" grip on the economy until more information is collected.

While there will be two full months of data before the Fed's Sept 16-17 meeting, Powell said the central bank was still in the early stages of understanding how Trump's rewrite of import taxes and other policy changes will unfold in terms of inflation, jobs and economic growth.

"You have to think of this as still quite early days," Powell said in a news conference after the release of the Fed's latest policy statement. "There's quite a lot of data coming in before the next meeting. Will it be dispositive? … It is really hard to say."

Lower probability

Those comments, and others that placed the burden on upcoming data to convince policymakers that lower rates were warranted, led investors to reduce the probability of a rate cut in September to less than 50 percent, after entering this week's two-day Fed meeting at nearly 70 percent.

Powell "made clear that he thinks the Fed has room to hold the fed funds rate steady for a period of time and wait and see how much tariffs affect inflation", said Bill Adams, chief economist at Comerica Bank, projecting that the central bank won't cut rates until its last meeting of the year in December. "If the unemployment rate holds steady and tariffs push up inflation, it will be hard to justify a rate cut in the next few months."

The latest policy decision was made by a 9-2 vote, which passes for a split outcome at the consensus-driven central bank, with two Fed governors dissenting for the first time in more than 30 years.

Trump has given Powell the pejorative nickname "Too Late" for his refusal to cut rates, but the Fed chief on Wednesday said he hoped to be right on time when the decision is made to lower borrowing costs, neither moving so soon that inflation reemerges, or waiting so long that the job market slides and the unemployment rate rises.

"In the end, there should be no doubt that we will do what we need to do to keep inflation controlled. Ideally, we do it efficiently," Powell told reporters.

Trump on Wednesday once again urged Powell to lower interest rates, citing better-than-expected GDP data in the second quarter.

"No inflation! Let people buy, and refinance, their homes!" Trump said in a post on social media.

Xinhua - Agencies