The right chemistry for pharma firms

Updated: 2012-01-09 09:40

By Liu Jie (China Daily)

|

|||||||||||

Common interest

Simcere's President Zhang Yehong said that the cooperation with BMS is based on mutual trust and common interests. Mark Pavao, president of BMS Emerging Markets and Global Access, said the partnership is exciting and hopefully will be a win-win situation.

"We have been committed to building up our R&D capability and are willing to invest significant financial and human resources (in China)," said Zhang, adding that Simcere invests between 7 and 8 percent of its sales in R&D every year.

Founded in 1995, the company now has almost 4,000 employees, with one-tenth of them working in R&D.

"Simcere is a leading Chinese company, a listed company (on the New York Stock Exchange) and very active in global partnership discussions," said Pavao. "We are pursuing 'selective integration' when choosing partners."

Regarding the company's second cooperative project in China, he said: "Our experience over the past year is that everything Simcere said they would do, they have done, ahead of schedule and with very high quality results, which made our companies think maybe we should talk about another one (project)."

According to the agreement, Simcere will receive exclusive rights to develop and commercialize the molecules in China, while BMS will retain exclusive rights in all other markets. The companies will jointly determine their strategic development plan to explore the potential of compounds to treat diseases.

At present, BMS provides molecules for Simcere. "Simcere will provide development expertise and resources to collect high-quality data, data that will stand up to potential applications around the world," said Pavao.

Some observers have said that BMS has an unfair advantage when cooperating with its Chinese partner: All intellectual property rights and income outside China will go to the overseas company, while the Chinese side is responsible for the whole R&D process, including financial investment and human resources.

However, Simcere's Zhang said he doesn't think the deal is skewed in favor of the overseas companies. "R&D collaboration is very complicated. Besides visible contributions, such as funds, equipment and human resources, there are many invisible things, such as the value of self-developed molecules, global resources and technological support," he said.

Zhang added that if a product is commercialized, Simcere will receive a "certain amount" of the revenue BMS generates from the medicine outside China, and in exchange, BMS will enjoy similar rights.

For many multinationals, their strong point is in early-stage molecular discovery, which requires a huge amount of money and can take decades of lab research. These relatively young Chinese biopharmaceutical companies can hardly be expected to discover those molecules by themselves, said Xu.

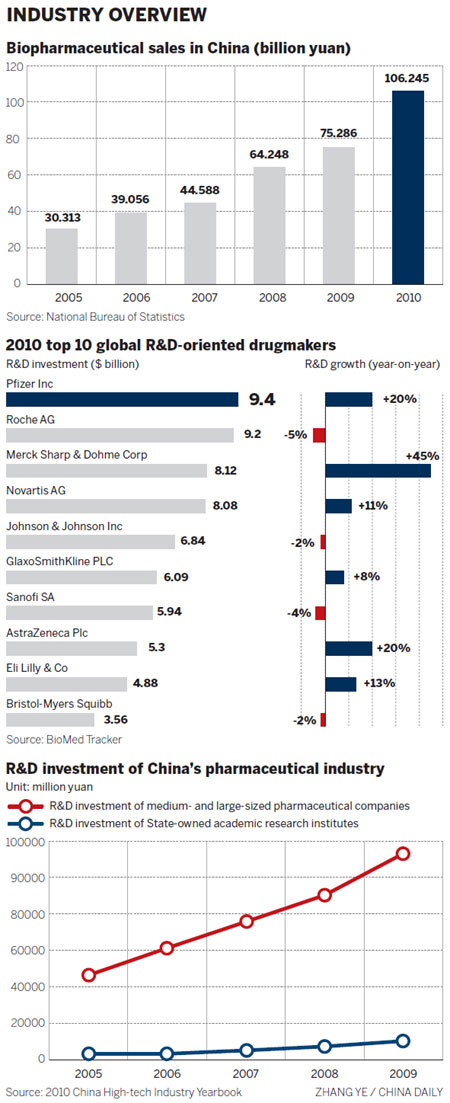

As a leading global biopharmaceutical company, BMS invests approximately 20 percent of its sales in R&D every year. Xu said that China has an advantage when it comes to clinical trials, because of the huge number of patients and the high standard of its R&D staff.

|

|

Challenges ahead

Biopharmaceutical development requires huge investment and carries high risks.

"What is important for people to understand is that each new drug costs approximately $1 billion and it takes an average of 12 years to develop a molecule into a medicine," said Chris H. Lee, president and CEO of Bayer HealthCare China, in an earlier interview.

"During the process, scientists filter the ideal drug out of millions of potential candidates, before selecting suitable candidates for clinical trials. Ultimately, only 5 to 10 percent of clinical candidates will receive regulatory approval," he said.

Many Chinese biopharmaceutical companies are very young and don't have the resources to devote to long-term development with huge investment, not to speak of shouldering the risk of the high possibility of failure, Liu said.

In collaboration with BMS, the foreign company has the resources for the molecular pipeline in its laboratory, but it does not have the resources for further development. "Partnering with us, they offer their early-stage technology and we focus on the next step, and our involvement greatly increases the possibility of success and reduces the risk of failure," said Zhang.

Cultural differences are also regarded as a potential hindrance for Sino-foreign R&D cooperation, Xu said.

There is a State-level biotech and pharmaceutical industrial base in Zhangjiang, Shanghai, which is known as China's "Drug Valley" and plays host to more than 100 drugmakers, including AstraZeneca Plc, Eli Lilly and Company and GlaxoSmithKline PLC as well as professional research institutions. Many of them have ongoing collaborative operative projects.

The administration committee at the Zhangjiang base has taken a number of measures - including hosting technology-transfer fairs, setting up specific departments to work as intermediary agencies and simplifying customs procedures for R&D equipment and biosample imports - to support partnerships between local institutions and foreign companies.

"It's a good way for Chinese academic institutions and enterprises to obtain funds to conduct more research and for foreign drugmakers to get reliable local resources to speed up their R&D in Zhangjiang," said Wang Lanzhong, general manager of the administration committee at the base.

Wang also said the heavy financial costs and long developmental period, coupled with the high failure rate in pharmaceutical R&D, have resulted in more than 500 local enterprises and institutions in Zhangjiang closing or moving out in the past decade.

Meanwhile, some projects don't last the agreed duration, mainly because the foreign and Chinese sides have different management ideologies and cannot compromise, said Liu, highlighting the importance of detailed and accurate contracts in addition to mutual understanding and communications.

"As market conditions continue to change, especially in China, where everything develops quickly, the partners should follow the changes and discuss appropriate responses, and then adjust their operations accordingly," Liu added.

However, Simcere's Zhang said he does not think the differences between Chinese and foreign cultures constitute a problem. "Cultural differences exist in all companies. There are differences between different multinational companies as between local companies. If two partners share the same philosophy and commitment, the problem will not be a problem at all."

|

|

|

A pharmaceutical exhibition in Shanghai.The increase in cooperation between foreign and domestic companies in R&D is a win-win solution, according to analysts.[Photo/Chinadaily] |

Zhang received his college and business education in the United States. He worked for Merck for 12 years and served as the company's China president between 2007 and 2008. With experience in international consulting firms IMS Healthcare and McKinsey & Company, Zhang is knowledgeable about the Western style of business and the condition of China's pharmaceutical industry.

The pursuit of internationalization by Chinese companies and the sluggish market in Western nations have resulted in many Chinese professionals returning from overseas to work for local companies. These people - usually open-minded, flexible and with good professional training - are becoming the backbone of cooperative projects. These human-resource flows can help narrow the cultural gap between Chinese and foreign companies to some extent, said Liu.

"Good partnership means finding good partners. For BMS, finding good partners means finding someone who has good science, focuses on innovation and has the ability to conduct general scientific work," said Pavao.

"If any Chinese company wants to be innovation-oriented and R&D-focused in looking for treatments for serious diseases, we may have an interest in partnering with them," Pointeau said, signaling that BMS China is open to domestic companies while insisting on "selective integration".

Related Stories

R&D Achievements 2011-07-17 09:35

Support for R&D increases 2011-04-15 06:18

Microsoft to add R&D staff 2011-07-28 09:51

AkzoNobel ups R&D in China 2011-06-14 08:05

Obama : le système d'immigration américain a besoin d'une réforme réelle et globale 2011-05-11 10:04

Toyota to invest $700m in China for R&D 2010-11-18 14:58

- Regional free trade talks in the pipeline

- China market retained auto sales crown

- The right chemistry for pharma firms

- Yum! takeover proposal approved

- Financial regulators to minimise systemic risks

- No room at the inn for some test-takers

- Chinese tourists flocking to neighbor

- Nationwide rush for home kicks off