Risks to GDP growth rising

Updated: 2011-12-29 07:55

By Gao Changxin (China Daily)

|

|||||||||||

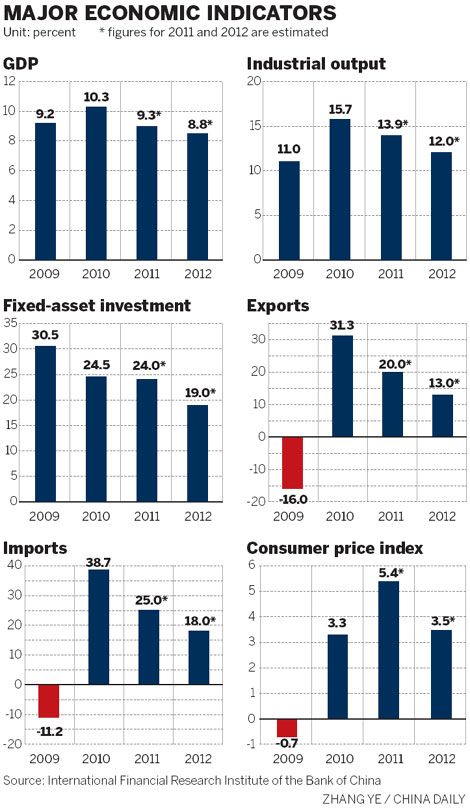

SHANGHAI - A sluggish global economy, domestic industrial overcapacity and a weak property market will pose increasing downside risk for the Chinese economy in 2012, Bank of China Ltd said on Wednesday.

Economic growth will slow to 8.8 percent in 2012 compared with 9.3 percent this year, the country's second-largest lender by assets said in a report.

Still, the bank's forecast was more optimistic than those from most other financial institutions. Last month, UBS AG lowered its forecast for China's 2012 GDP growth to 8 percent from 8.3 percent previously. Citigroup Inc revised its forecast to 8.4 percent from 8.7 percent, and HSBC Holdings PLC said on Dec 22 that China's economy would grow 8.6 percent next year.

Cao Yuanzheng, Bank of China's chief economist, said that growth would hit bottom in the first quarter next year on a quarter-on-quarter basis, while year-on-year growth would bottom out in the second quarter. Growth would bounce back in the second half, he said. The second-half rebound would be supported by looser monetary policy. Though the country has said it would maintain a "prudent" monetary stance, further loosening had become more likely, the bank said.

It added that with inflation having slowed, there was room for further cuts in the reserve-requirement ratio (RRR). On Dec 1, the central bank lowered the RRR for commercial banks by 50 basis points.

The International Monetary Fund said in September that the global economy would expand 4 percent in 2012, with developed countries growing only 1.9 percent.

Slow global growth would hurt China's exports, which mainly go to developed countries, the bank said. It forecast that exports would grow 13 percent next year to generate a trade surplus of only about $82.3 billion.

The trade surplus in the first 11 months of this year reached $138.4 billion, down 18.2 percent year-on-year, according to the Ministry of Commerce.

"China's exports face huge pressure and growth will further slow next year," said Zhen Feng, an economist with the Bank of China. "Net exports will contribute less to economic growth, or even make a negative contribution."

Chinese enterprises would start de-stocking next year after having quickly expanded production over the past two to three years, which would slow industrial activity and growth, said the bank.

Inventories of industrial enterprises surged 24.2 percent in the first 10 months of this year to 2.75 trillion yuan ($434.7 billion), a six-year high.

The National Bureau of Statistics has reported that the profit growth of industrial enterprises in the first 11 months of the year decelerated to 24.4 percent from 25.3 percent in the first 10 months.

De-stocking, the bank said, would have "important effects" on employment and industrial output.

Tightening policies aimed at the real estate sector, which plays a significant part in the economy, wouldn't change next year, and a sluggish property market would have negative effects on fiscal revenue and related industries, the bank said. The bank said credit tightening earlier this year had successfully reined in consumer inflation, which would continue to slow to reach 3.5 percent in 2012 - down 1.9 percentage points from this year.

Related Stories

China's GDP growth likely to slow to 9.2% in '11 2011-11-24 13:57

China's GDP to grow 9.6% in 2011 2011-04-06 10:27

China vows to ensure stable economic growth 2010-12-12 18:13

Experts call for slower economic growth 2011-01-26 07:06

- China adds 12m new jobs in 2011

- Wenzhou crash 'due to design failures'

- Mengniu shares plunge on milk scare

- Alibaba opens doors to its group-buying platform

- Nine employers arrested for withholding wages

- COFCO plans to expand global logistics system

- Agriculture still vital to China

- Agriculture a fertile field for investment