Economic growth slowest in two years

Updated: 2012-01-18 09:11

By Chen Jia and Yu Ran (China Daily)

|

|||||||||||

Weaker export demand and cooling real estate cited as reasons by NBS

BEIJING / SHANGHAI - The economy, buffeted by weaker export demand and cooling real estate investment, grew at its slowest pace in more than two years, according to the National Bureau of Statistics (NBS).

Analysts predict that the latest figures may prompt the government to introduce stimulus policies.

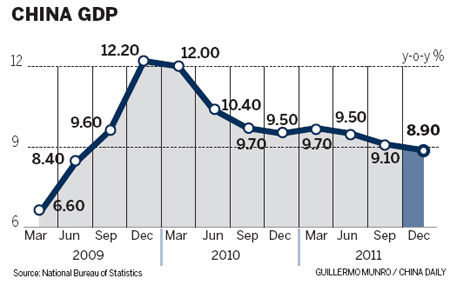

Full-year GDP growth was 9.2 percent. But, crucially, GDP growth was 8.9 percent for the October-to-December period from a year earlier. This was the slowest quarterly increase since the second quarter of 2009, following the global financial crisis.

GDP growth in 2010 was 10.4 percent, according to the NBS.

|

|

The world's second-largest economy is expected to face a "more difficult and more complicated economic situation in 2012", Ma Jiantang, head of the NBS, told a news conference organized by the State Council Information Office.

Economists expected that the slowdown might continue in the coming months, as Europe flirts with recession and the US recovery has yet to take hold.

A ratings downgrade in Europe and the breakdown in Greek bailout talks have raised concerns about the continent's outlook.

There has been increased speculation that authorities may ease monetary policy and expand fiscal spending to boost consumption.

"The cooling economy may push the government to increase investment on infrastructure and help avoid a hard landing," said Tang Jianwei, a senior economist with the Bank of Communications.

|

|

Stocks rose sharply after the data was released. The benchmark Shanghai Composite Index surged by 4.2 percent at the close on Tuesday, the biggest jump since October 2009.

Shares in more than 100 companies hit the 10 percent ceiling on Tuesday, driving up expectations that the government may cut the reserve requirement for commercial banks and unveil more measures to boost the markets.

Inflationary pressure may remain in the long term, because of increasing labor costs and the fluctuation of resource prices, Ma said.

According to the NBS, the real growth in fixed-asset investment was 16.1 percent last year, down from 19.5 percent in 2010. Meanwhile, investment in real estate increased by 27.9 percent year-on-year, 5.3 percentage points lower than 2010.

The government has taken measures to cool the property market, even though that sector has helped drive economic growth in recent years.

"The biggest domestic risk in 2012 may come from the housing market," said Zhu Haibin, the chief economist in China with JPMorgan Chase Bank Co. "The housing market turnaround is mainly policy-driven, and the tightening process is not over yet."

He predicted that property prices may drop, on average, by 5-10 percent.

However, NBS chief Ma did not think that falling prices would usher in credit defaults by local governments.

The nation's industrial output increased by 12.8 percent in December from a year earlier, compared with 12.4 percent in November and 13.2 percent in October.

However, medium- and small-sized businesses are still having difficulties with tight financing, pressure to improve energy conservation and reducing emissions, Ma said.

One such business has seen an increase in domestic buyers.

"We have overcome hard times during the past year with a sharp decline in orders and labor shortages," He Zheng'an, a cosmetics retailer from Yiwu, in Zhejiang province, said.

"Conditions improved in the third quarter because more domestic consumers bought our products," He said.

The People's Bank of China, the central bank, cut the amount of money that commercial banks should set aside in November for the first time in three years in response to the economic slowdown and to support small-scale businesses.

The consumer price index (CPI), a main gauge of inflation, eased in December to a 15-month low of 4.1 percent from a 37-month high of 6.5 percent in July.

"The more benign outlook for inflation has given policymakers greater leeway to allow further monetary policy easing," said Jing Ulrich, chairman of global markets for China at JPMorgan Chase & Co.

Ulrich expected the reserve requirement for banks to be cut three times in the first half of this year, and new yuan loans to increase to 8.2 trillion yuan ($1.3 trillion) this year.

- Investors search for new investment channels

- HK stocks surge 3.24% Tuesday

- Chinese shares rally 4.18% on GDP data

- Amazon expands business in SW China

- China to approve more qualified foreign investors

- Internet use rises at slower pace in 2011

- China's 2011 GDP growth slows to 9.2%

- London set for a role in yuan transactions