Chinese venture capital and private equity companies will see a record year in 2013 measured by both the number and value of the deals they complete, according to senior executives at the global accounting firm PricewaterhouseCoopers LLP.

Even so, they will still find it difficult to exit from some of their investments, they said.

"Deal activity is likely to strengthen from the second quarter of 2013 as global economic conditions become more settled, pricing expectations for China adjust, IPO markets re-open and China's leadership transition takes effect," said Vincent Cheuk, Northern China leader of the private equity group at PwC China.

"We believe that 2013 will be a record year for the (venture capital and private equity) market in China, and its development in the mid-term will be strong."

He said many Chinese companies that are supported by venture capital or private equity are seeking to be listed.

More than 800 companies are now waiting to go public on Chinese mainland stock exchanges.

"Mergers and acquisitions and secondary sales will become more frequent," he said.

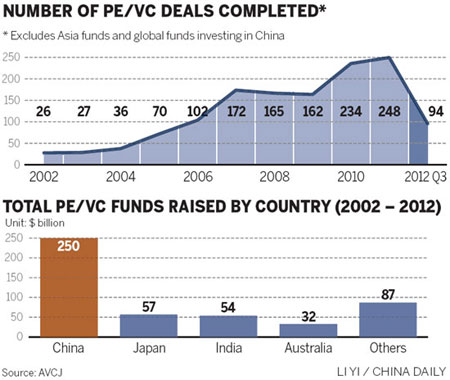

According to a report by PwC on Thursday, China-focused venture capital and private equity companies raised $35.8 billion in the first three quarters of the year, close to the amount for the same period of last year.

In 2011, such companies raised $48 billion, equal to about 17 percent of global equity investment fundraising for that year.

"While fundraising conditions for mid-tier and less-established funds are becoming tougher, high-quality funds can still find ways to access capital," said Ni Qing, a partner in the private equity group at PwC China.

Ni said a China-focused fund at the private equity firm KKR & Co LP managed to raise $3 billion this year, and a similar fund at Hony Capital Co Ltd raised $2.4 billion.

In Asia, China has been the single largest equity investment destination for the last six years.

The value of venture capital and private equity deals in the Chinese market made up more than 40 percent of those in Asia in 2011 and in the first three quarters of this year.

Compared with the total deal value for the entire world, though, China's share is much smaller, a result in part of there having been relatively few extremely large deals in the Chinese market.

"Growth capital deals are predominant in China, but (private investment in public equity) deals are important and we are seeing a buy-out market starting to emerge," said Nie Lei, a partner of transaction services at PwC China.

caixiao@chinadaily.com.cn