Warning: Yuan bill to spark trade war

Updated: 2011-10-11 07:06

By Wu Jiao and Cui Haipei (China Daily)

|

|||||||||||

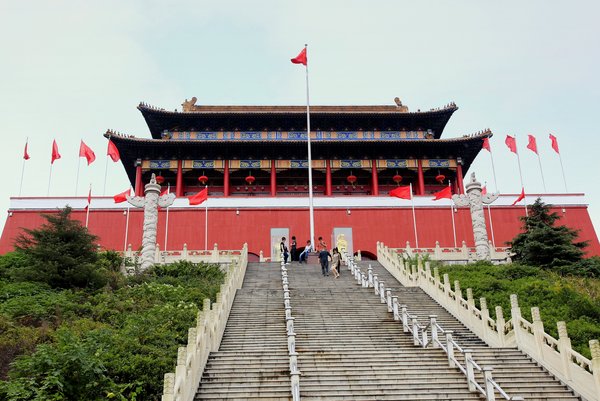

BEIJING - China warned the United States on Monday of a trade war if Congress passes a bill pressuring Beijing to appreciate the yuan. The warning came a day before US lawmakers are set to vote on the bill.

Vice-Foreign Minister Cui Tiankai reiterated Beijing's opposition to the bill and said that it will hamper global economic recovery and further hurt US jobs growth.

"Should the proposed legislation be made into law, the result would be a trade war between China and the US and that would be a lose-lose situation for both sides," Cui said at a news briefing.

The bill is likely to pass with bipartisan support in the Senate, before being sent to the House of Representatives.

The bill would require the US Department of Commerce to estimate what they claim to be currency under-valuations when calculating duties imposed on imports deemed to be State-subsidized.

"(The currency bill) in no way represents the reality of the economic and trade relationship" between the two leading economies, said Cui, who currently heads the China delegation for G20 negotiations.

"Of course it would be detrimental to the development of economic ties and might have an adverse impact on bilateral relations.

"If this type of situation occurs, it would certainly have negative effects on US economic and job growth," he said. "At the same time, it would hinder global economic recovery."

The legislation, if passed in the Senate, still faces an uncertain future in the House of Representatives.

Republican House Speaker John Boehner has signaled that the legislation will die.

"It's dangerous. You could start a trade war. And a trade war, given the economic uncertainty here and all around the world - it's just very dangerous, and we should not be engaged in this," Boehner said last Thursday.

China's central bank and the ministries of commerce and foreign affairs last week jointly warned that the proposed currency law could lead to a trade war between the two countries.

Some US politicians claim that China holds down the value of its currency to give its exporters an edge. But Beijing says it is committed to gradual reform of the yuan, which has risen 30 percent against the greenback since 2005.

The yuan hit a fresh high against the US dollar late on Monday, up 0.6 percent from 6.3859 on Sept 30 to 6.3486. China's financial markets were closed for National Day holidays last week.

It represents the highest closing level since the country unified the official and market exchange rates at the end of 1993, according to the China Foreign Exchange Trade System.

It is also the biggest daily increase since China loosened the yuan's peg to the dollar on July 21, 2005.

The Wall Street Journal carried an article on Oct 7 which quoted a Boston Consulting Group study, saying that due to rising labor and raw material costs in China, "the jobs that some US politicians want to bring home may already be trickling back to the US".

The study calculates that production that returns to the US from China could add 800,000 jobs in the manufacturing sector, and up to 3 million altogether if service-sector support jobs are included, according to the article.

Wang Haifeng, a senior researcher with the Foreign Economic Research Institute, a think tank for the National Development and Reform Commission, told China Daily that the currency bill may damage the US more than China, because trade friction will reduce imports from China.

"The passage of this bill will surely spark a trade war and US consumers would be the final victims," Wang said. Whether this currency issue will have long-term effects on the Sino-US trade relationship depends on how quick the US economy recovers, he added.

The US imposing sanctions on China would violate international trade rules, said Cao Fengqi, director of the Finance and Securities Research Center at Peking University.

"The US should not blame China for its trade deficit and high unemployment," he said.

"The bill will be unfavorable for Chinese exports. China may also take retaliatory measures, including raising tariffs on imports from the US," Cao said. However, he believed the bill has little chance of passing in the House.

Economist Robert Mundell, winner of the Nobel Prize, said that US legislation to press China to raise the value of the yuan would be a "disaster".

"This is not going to help Americans," Mundell said on Sept 27 in a Bloomberg Television interview. "This is not going to create jobs for Americans. It's just going to create a disaster.

"This would have a wounding effect on the stability of international relations. There's never been any precedent in economic history where a country, through any legal system, was forced to appreciate its currency relative to another country."

Also at the news briefing, Cui said China will once again raise the issue of US arms sales to Taiwan at a high-level meeting in Beijing on Tuesday.

The meeting will be co-hosted by Cui and US Assistant Secretary of State Kurt Campbell.

Cui reiterated that US arms sales to Taiwan seriously undermine China's core interests. The US said last month that it would sell $5.85 billion in military hardware to the island.

Reuters and Chen Jia contributed to this story.

Related Stories

White House voices concern on China currency bill 2011-10-06 07:41

Vote on currency bill set to next week 2011-10-08 08:10

People's Daily calls US bill on yuan 'buck-passing' 2011-10-05 12:04

Boehner: Currency bill on China 'dangerous' 2011-10-05 09:40

China 'firmly opposes' US Senate's yuan bill 2011-10-04 10:13

US bill on yuan does more harm than good 2011-10-04 07:14

Hot Topics

Libya conflict, Gaddafi, Oil spill, Palace Museum scandal, Inflation, Japan's new PM, Trapped miners, Mooncake tax, Weekly photos, Hurricane Irene

Editor's Picks

|

|

|

|

|

|