Risk high on agenda of financial meeting

Updated: 2012-01-04 07:50

By Wang Xiaotian and Li Xiang (China Daily)

|

|||||||||

|

The headquarters of the People's Bank of China in Beijing. Analysts suggest that the financial regulation under the framework of the central bank and three financial regulators be improved. Wu Changqing / For China Daily |

BEIJING - Risk control is expected to be a chief topic during the approaching two-day National Financial Work Conference, and a new financial State-owned assets regulator is expected to serve that purpose, analysts said.

Ba Shusong, a researcher at the State Council's development research center, said the conference on Friday and Saturday is likely to focus on managing and resolving financial risks in the post-crisis era, as the European sovereign debt crisis worsens and the global economy faces the risk of a double-dip recession.

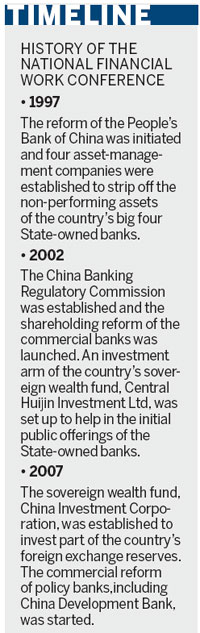

The conference has convened every five years since 1997. It is widely seen as an event that sets the tone for financial reforms and formulates multi-year plans for the entire financial system, including the creation of new institutions.

A plan to set up a financial State-owned assets supervision and administration commission, which would operate at the ministry level as both an investor and a regulator of the financial sector, has already been approved by the State Council, or cabinet, the Beijing-based China Times reported on Tuesday, citing an anonymous source.

The existing regulator, the State-owned Assets Supervision and Administration Commission, doesn't have jurisdiction over financial institutions.

"In view of rising uncertainties related to debt problems in Europe and the US, decision- makers expect the newly established commission could be less market-oriented to counter financial risks," said the source.

The newspaper said that Vice-Finance Minister Li Yong has been recommended as a candidate to lead the new commission, which would combine the financial management authority of the finance department of the Finance Ministry, the central bank, the China Banking Regulatory Commission (CBRC) and Central Huijin Investment Ltd.

"Setting up a national administrative authority to exercise the roles of owner and investor of State-owned assets could spark worries about its efficiency and management. It would be a step backward of China's financial regulation reform," said Guo Tianyong, director of the Research Center of the Chinese Banking Industry at the Central University of Finance and Economics.

He said the government function has expanded a bit too much in the past few years and should be limited.

"More should be done to explore market-oriented governance and regulation," Guo said.

Wang Guogang, head of the finance and banking institute at the Chinese Academy of Social Sciences, said that strengthening the comprehensive system of financial regulation could be on the agenda of the conference.

"The existing (system of) financial regulation under the framework of the central bank and three financial regulators could prevent financial risks within a certain period of time. But it is undeniable that regulatory duplication co-exists with a regulatory 'vacuum' and coordination among various regulatory authorities is very much needed," Wang said.

The previous three meetings, in 1997, 2002 and 2007, led to significant policy changes, such as the reform of the People's Bank of China, the central bank, as well as State-owned commercial lenders and policy banks, and the establishment of the China Insurance Regulatory Commission (CIRC), the CBRC and the China Investment Corporation.

But some analysts said that the upcoming meeting would not achieve as many breakthroughs as did the previous conferences, as the authorities are inclined to emphasize stability.

The three financial regulators - the China Securities Regulatory Commission (CSRC), CBRC and CIRC - have drafted three documents for the conference to discuss IPO reform, delisting mechanisms, financial innovations for services to small enterprises and the industrial restructuring of the insurance sector, the China Times reported.

Hot Topics

Kim Jong-il, Mengniu, train crash probe, Vaclav Havel, New Year, coast guard death, Internet security, Mekong River, Strait of Hormuz, economic work conference

Editor's Picks

|

|

|

|

|

|